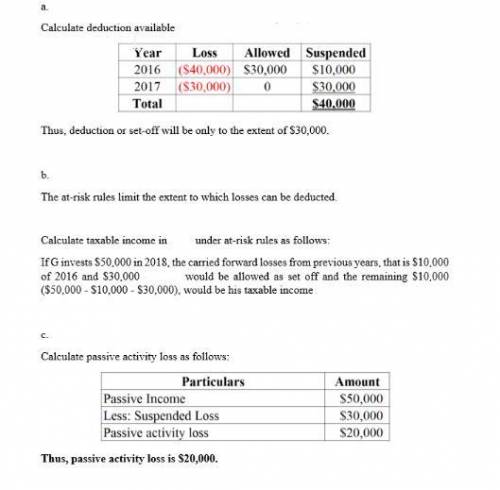

Assuming gerald has $50,000 income in 2020, (and considering both at-risk and passive activity loss rules), what is the amount of gerald's suspended losses at the end of 2020?

suspended under the at-risk rules: $

suspended under the passive activity loss rules: $

what is his taxable income for 2020? $

at the end of 2020, what is the amount of gerald's adjusted basis in the activity?

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Astock is selling today for $50 per share. at the end of the year, it pays a dividend of $3 per share and sells for $58. a. what is the total rate of return on the stock? (enter your answer as a whole percent.) b. what are the dividend yield and percentage capital gain? (enter your answers as a whole percent.) c. now suppose the year-end stock price after the dividend is paid is $42. what are the dividend yield and percentage capital gain in this case? (negative amounts should be indicated by a minus sign. enter your answers as a whole percent.)

Answers: 1

Business, 22.06.2019 22:50

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

Business, 23.06.2019 01:30

What are six resources for you decide which type of business to start and how to start it?

Answers: 3

Business, 23.06.2019 02:00

Which type of unemployment would increase if workers lost their jobs because their positions were replaced by an automated process? a) cyclical b) frictional c) international d) structural

Answers: 1

You know the right answer?

Assuming gerald has $50,000 income in 2020, (and considering both at-risk and passive activity loss...

Questions

Computers and Technology, 05.09.2020 01:01

Computers and Technology, 05.09.2020 01:01

Social Studies, 05.09.2020 01:01

Mathematics, 05.09.2020 01:01

Mathematics, 05.09.2020 01:01

Mathematics, 05.09.2020 01:01