Business, 28.11.2019 04:31 braisly6605

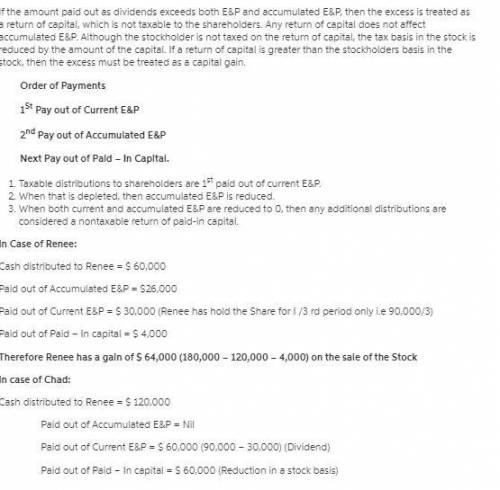

Renee, the sole shareholder of indigo corporation, sold her stock to chad on july 1 for $180,000. renee's stock basis at the beginning of the year was $120,000. indigo made a $60,000 cash distribution to renee immediately before the sale, while chad received a $120,000 cash distribution from indigo on november 1. as of the beginning of the current year, indigo had $26,000 in accumulated e & p, while current e & p (before distributions) was $90,000. which of the following statements is correct? renee recognizes a $60,000 gain on the sale of the stock. a. b. renee recognizes a $64,000 gain on the sale of the stock. c. chad recognizes dividend income of $120,000. d. chad recognizes dividend income of $30,000. e. none of the above.

Answers: 1

Another question on Business

Business, 22.06.2019 10:00

University car wash built a deluxe car wash across the street from campus. the new machines cost $219,000 including installation. the company estimates that the equipment will have a residual value of $19,500. university car wash also estimates it will use the machine for six years or about 12,500 total hours. actual use per year was as follows: year hours used 1 3,100 2 1,100 3 1,200 4 2,800 5 2,600 6 1,200 prepare a depreciation schedule for six years using the following methods: 1. straight-line. 2. double-declining-balance. 3. activity-based.

Answers: 1

Business, 22.06.2019 11:00

How did the contribution of the goods producing sector to gdp growth change between 2010 and 2011 a. it fell by 0.3%. b. it fell by 2.3%. c. it rose by 2.3%. d. it rose by 0.6%. the answer is b

Answers: 1

Business, 22.06.2019 12:20

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

You know the right answer?

Renee, the sole shareholder of indigo corporation, sold her stock to chad on july 1 for $180,000. re...

Questions

Biology, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

Chemistry, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

Chemistry, 07.07.2019 22:00

History, 07.07.2019 22:00

History, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

Physics, 07.07.2019 22:00

Biology, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

History, 07.07.2019 22:00

Social Studies, 07.07.2019 22:00

Mathematics, 07.07.2019 22:00

History, 07.07.2019 22:00