The following information relates to the debt securities investments of wildcat company.

...

Business, 28.11.2019 00:31 wywy122003

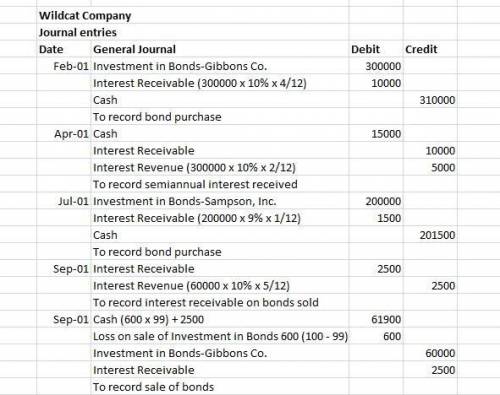

The following information relates to the debt securities investments of wildcat company.

1.

on february 1, the company purchased 10% bonds of gibbons co. having a par value of $300,000 at 100 plus accrued interest. interest is payable april 1 and october 1.

2.

on april 1, semiannual interest is received.

3.

on july 1, 9% bonds of sampson, inc. were purchased. these bonds with a par value of $200,000 were purchased at 100 plus accrued interest. interest dates are june 1 and december 1.

4. on september 1, bonds with a par value of $60,000, purchased on february 1, are sold at 99 plus accrued interest.

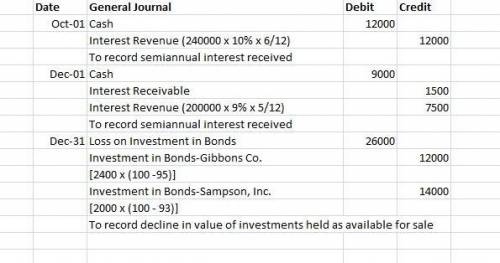

5. on october 1, semiannual interest is received.

6. on december 1, semiannual interest is received.

7.

on december 31, the fair value of the bonds purchased february 1 and july 1 are 95 and 93, respectively.

prepare any journal entries you consider necessary, including year-end entries (december 31), assuming these are available-for-sale securities.

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

For many years, kellogg's frosted flakes, a ready-to-eat breakfast cereal, was perceived as a cereal for children. tony the tiger, a cartoon character, extolled frosted flakes, and advertisements depicted children enjoying the product with tony in competitive situations. recently, in response to declining sales of frosted flakes, the cereal maker has adopted a new series of advertisements that show adults admitting that they enjoy frosted flakes, too. kellogg's is attempting to

Answers: 1

Business, 22.06.2019 02:30

Required information [the following information applies to the questions displayed below.] the following data is provided for garcon company and pepper company. garcon company pepper company beginning finished goods inventory $ 13,800 $ 18,850 beginning work in process inventory 16,700 20,700 beginning raw materials inventory 8,800 13,500 rental cost on factory equipment 28,250 26,650 direct labor 22,400 37,400 ending finished goods inventory 17,300 14,300 ending work in process inventory 23,200 19,400 ending raw materials inventory 5,900 9,600 factory utilities 11,250 15,000 factory supplies used 10,900 5,700 general and administrative expenses 32,500 44,500 indirect labor 2,500 9,880 repairs—factory equipment 4,820 2,150 raw materials purchases 41,500 63,000 selling expenses 54,800 49,000 sales 238,530 317,510 cash 33,000 23,700 factory equipment, net 222,500 124,825 accounts receivable, net 13,400 23,950 required: 1. complete the table to find the cost of goods manufactured for both garcon company and pepper company for the year ended december 31, 2017. 2. complete the table to calculate the cost of goods sold for both garcon company and pepper company for the year ended december 31, 2017.

Answers: 2

Business, 22.06.2019 02:50

Grey company holds an overdue note receivable of $800,000 plus recorded accrued interest of $64,000. the effective interest rate is 8%. as the result of a court-imposed settlement on december 31, year 3, grey agreed to the following restructuring arrangement: reduced the principal obligation to $600,000.forgave the $64,000 accrued interest.extended the maturity date to december 31, year 5.annual interest of $40,000 is to be paid to grey on december 31, year 4 and year 5. the present value of the interest and principal payments to be received by grey company discounted for two years at 8% is $585,734. grey does not elect the fair value option for reporting the debt modification. on december 31, year 3, grey would recognize a valuation allowance for impaired loans of

Answers: 3

Business, 22.06.2019 05:00

The new york stock exchange is an example of what type of stock market?

Answers: 1

You know the right answer?

Questions

Mathematics, 24.07.2020 03:01

Mathematics, 24.07.2020 03:01

History, 24.07.2020 03:01

Mathematics, 24.07.2020 03:01