Business, 28.11.2019 00:31 msjbryant33

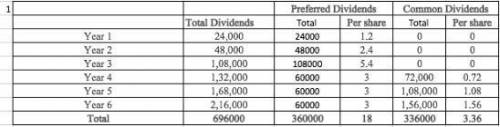

Pecan theatre inc. owns and operates movie theaters throughout florida and georgia. pecan theatre has declared the following annual dividends over a six-year period: year 1, $24,000; year 2, $48,000; year 3, $108,000; year 4, $132,000; year 5, $168,000; and year 6, $216,000. during the entire period ended december 31 of each year, the outstanding stock of the company was composed of 20,000 shares of cumulative preferred 3% stock, $100 par, and 100,000 shares of common stock, $15 par.1. determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. there were no dividends in arrears at the beginning of 20y1. summarize the data in tabular form. if required, round your answers to two decimal places. if the amount is zero, enter "0".

Answers: 2

Another question on Business

Business, 22.06.2019 01:50

Which statement below best describes george waring's approach to solving the problems of water-borne illness? a. waring is going with his "gut," because he believes that instincts and emotions are the best guides for action. b. waring efficiently and thoroughly lays out the case for why the problems are too large and overwhelming to be solved: people should just move out of cities back to their farms. c. waring has gathered the testimonies of people who live in densely populated areas in order to learn how they themselves have solved their problems. d. waring exhibits the industrial age's increased respect for and reliance on science and the scientific method.

Answers: 1

Business, 22.06.2019 10:30

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 12:20

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

Business, 22.06.2019 17:00

Aaron corporation, which has only one product, has provided the following data concerning its most recent month of operations: selling price $ 102 units in beginning inventory 0 units produced 4,900 units sold 4,260 units in ending inventory 640 variable costs per unit: direct materials $ 20 direct labor $ 41 variable manufacturing overhead $ 5 variable selling and administrative expense $ 4 fixed costs: fixed manufacturing overhead $ 64,200 fixed selling and administrative expense $ 2,900 the total contribution margin for the month under variable costing is:

Answers: 2

You know the right answer?

Pecan theatre inc. owns and operates movie theaters throughout florida and georgia. pecan theatre ha...

Questions

Mathematics, 17.03.2020 21:28

Biology, 17.03.2020 21:28

Social Studies, 17.03.2020 21:29

Chemistry, 17.03.2020 21:29

Mathematics, 17.03.2020 21:29

English, 17.03.2020 21:29

Mathematics, 17.03.2020 21:29