Marine components produces parts for airplanes and ships. the parts are produced to specification by their customers, who pay either a fixed price (the price does not depend directly on the cost of the job) or price equal to recorded cost plus a fixed fee (cost plus). for the upcoming year (year 2), marine expects only two clients (client 1 and client 2). the work done for client 1 will all be done under fixed-price contracts while the work done for client 2 will all be done under cost-plus contracts.

manufacturing overhead for year 2 is estimated to be $10 million. other budgeted data for year 2 include:

client 1

machine hours (thousands) - 2000

direct labor cost ($000) - $2500

client 2machine hours (thousands) - 2000direct labor cost ($000) - $7500

compute the predetermined rate assuming that marine components uses machine-hours to apply overhead.

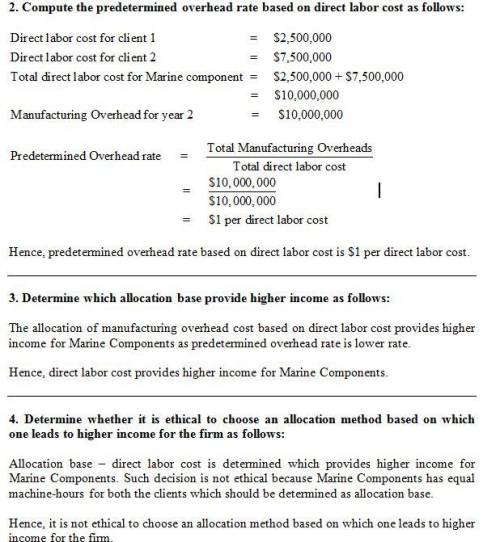

compute the predetermined rate assuming that marine components uses direct labor cost to apply overhead.

which allocation base will provide higher income for marine components?

is it ethical to choose an allocation method based on which one leads to higher income for the firm?

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

In order to gauge public opinion about how to handle iran's growing nuclear program, a research group surveyed 1010 americans by telephone and asked them to rate the threat iran's nuclear program poses to the world on a scale of 1 to 10. describe the population, sample, population parameters, and sample statistics. identify the population in the given problem. choose the correct answer below.

Answers: 2

Business, 22.06.2019 02:00

Corporations with suppliers, vendors, and customers all over the globe are referred to as : a) global corporations b) international corporations c) multinational corporations d) multicultural corporations

Answers: 2

Business, 22.06.2019 16:30

En major recording acts are able to play at the stadium. if the average profit margin for a concert is $175,000, how much would the stadium clear for all of these events combined?

Answers: 3

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

You know the right answer?

Marine components produces parts for airplanes and ships. the parts are produced to specification by...

Questions

Mathematics, 07.07.2019 16:30

Biology, 07.07.2019 16:30

Biology, 07.07.2019 16:30

Mathematics, 07.07.2019 16:30

History, 07.07.2019 16:30

English, 07.07.2019 16:30

Mathematics, 07.07.2019 16:30

English, 07.07.2019 16:30