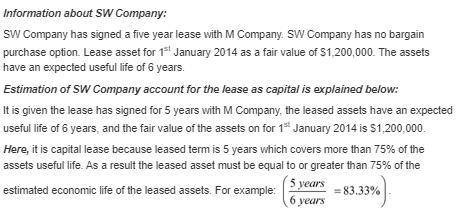

On january 1, 2017, seven wonders inc. signed a five-year noncancelable lease with moss company. the lease calls for five payments of $277,409.44 to be made at the end of each year. the leased asset has a fair value of $1,200,000 on january 1, 2017. seven wonders cannot renew the lease, there is no bargain purchase option, and ownership of the leased asset reverts to moss at the lease end. the leased asset has an expected useful life of six years, and seven wonders uses straight-line depreciation for financial reporting purposes. its incremental borrowing rate is 12%. moss’s implicit rate of return on the lease is unknown. seven wonders uses a calendar year for financial reporting purposes. both companies use asc 840 to account for leases.

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Florence invested in a factory requiring. federally-mandated reductions in carbon emissions. how will this impact florence as the factory's owner? a. her factory will be worth less once the upgrades are complete. b. her factory will likely be bought by the epa. c. florence will have to invest a large amount of capital to update the factory for little financial gain. d. florence will have to invest a large amount of capital to update the factory for a large financial gain.

Answers: 1

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

Business, 22.06.2019 19:40

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

You know the right answer?

On january 1, 2017, seven wonders inc. signed a five-year noncancelable lease with moss company. the...

Questions

Mathematics, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Spanish, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Advanced Placement (AP), 26.10.2020 20:00

English, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

English, 26.10.2020 20:00

Social Studies, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Mathematics, 26.10.2020 20:00

Biology, 26.10.2020 20:00