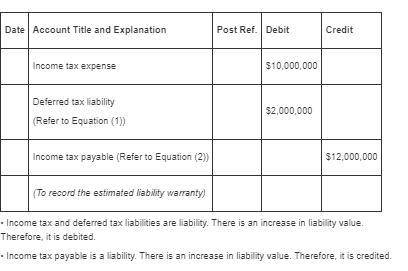

Bronson industries reported a deferred tax liability of $8 million for the year ended december 31, 2017, related to a temporary difference of $20 million. the tax rate was 40%. the temporary difference is expected to reverse in 2019 at which time the deferred tax liability will become payable. there are no other temporary differences in 2017–2019. assume a new tax law is enacted in 2018 that causes the tax rate to change from 40% to 30% beginning in 2019. (the rate remains 40% for 2018 taxes.) taxable income in 2018 is $30 million. required: 1. & 2. determine the type of accounting change and prepare the appropriate journal entry to record bronson's income tax expense in 2018 and adjustment, if any, is needed to revise retained earnings as a result of the change.

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

You know the right answer?

Bronson industries reported a deferred tax liability of $8 million for the year ended december 31, 2...

Questions

Mathematics, 16.08.2020 01:01

Mathematics, 16.08.2020 01:01

Biology, 16.08.2020 01:01

Social Studies, 16.08.2020 01:01

Mathematics, 16.08.2020 01:01

English, 16.08.2020 01:01

Mathematics, 16.08.2020 01:01

Social Studies, 16.08.2020 01:01

Chemistry, 16.08.2020 01:01

Mathematics, 16.08.2020 01:01