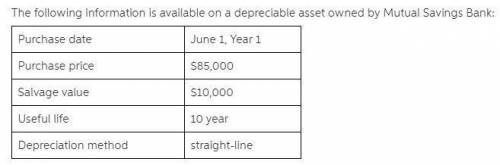

The asset's book value is $70,000 on july 1, year 3. on that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. based on this information, the amount of depreciation expense the company should recognize during the last six months of year 3 would be:

a. $8,125.00

b. $7,375.00

c. $4,062.50

d. $3,750.00

e. $7,812.50

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

Costs of production that do not change when output changes.question 17 options: total revenuefixed incometotal costfixed cost

Answers: 1

Business, 22.06.2019 09:40

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

You know the right answer?

The asset's book value is $70,000 on july 1, year 3. on that date, management determines that the as...

Questions

Mathematics, 25.03.2020 05:40

Computers and Technology, 25.03.2020 05:40

Physics, 25.03.2020 05:40

Mathematics, 25.03.2020 05:40

Mathematics, 25.03.2020 05:40