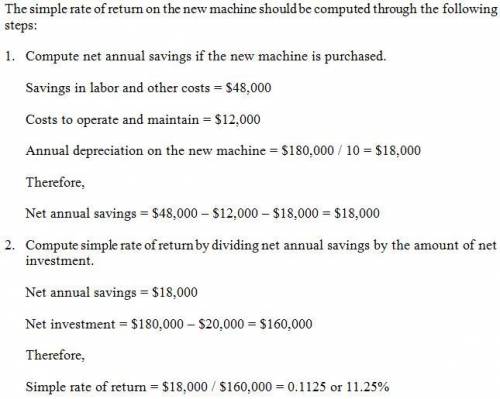

(ignore income taxes in this problem.) blaine corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. the new machine would cost $180,000 and would have a ten-year useful life. unfortunately, the new machine would have no salvage value. the new machine would cost $12,000 per year to operate and maintain, but would save $48,000 per year in labor and other costs. the old machine can be sold now for scrap for $20,000. what is the simple rate of return on the new machine (round off your answer to the nearest one-hundredth of a percent)? select one:

1) 10.00%2) 26.67%3) 22.50%4) 11.25%show work

Answers: 2

Another question on Business

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

Business, 22.06.2019 20:50

Many potential buyers value high-quality used cars at the full-information market price of € p1 and lemons at € p2. a limited number of potential sellers value high-quality cars at € v1 ≤ p1 and lemons at € v2 ≤ p2. everyone is risk neutral. the share of lemons among all the used cars that might be potentially sold is € θ . suppose that the buyers incur a transaction cost of $200 to purchase a car. this transaction cost is the value of their time to find a car. what is the equilibrium? is it possible that no cars are sold

Answers: 2

Business, 23.06.2019 01:00

Lycan, inc., has 7.5 percent coupon bonds on the market that have 8 years left to maturity. the bonds make annual payments and have a par value of $1,000. if the ytm on these bonds is 9.5 percent, what is the current bond price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) current bond price

Answers: 2

You know the right answer?

(ignore income taxes in this problem.) blaine corporation is considering replacing a technologically...

Questions

English, 11.03.2022 06:10

Advanced Placement (AP), 11.03.2022 06:10

Chemistry, 11.03.2022 06:10

History, 11.03.2022 06:10

Health, 11.03.2022 06:10

Chemistry, 11.03.2022 06:10

Business, 11.03.2022 06:10

History, 11.03.2022 06:20

Mathematics, 11.03.2022 06:20

Mathematics, 11.03.2022 06:20