Business, 26.11.2019 23:31 juanmercs99

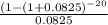

Suppose you earned a $275,000 bonus this year and invested it at 8.25% per year. how much could you withdraw at the end of each of the next 20 years? select one: a. $28,532 b. $29,959 c. $31,457 d. $33,030 e. $34,681

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

In business,what would be the input, conversion and output of operating a summer band camp

Answers: 1

Business, 21.06.2019 20:20

Miller mfg. is analyzing a proposed project. the company expects to sell 8,000 units, plus or minus 2 percent. the expected variable cost per unit is $11 and the expected fixed costs are $287,000. the fixed and variable cost estimates are considered accurate within a plus or minus 5 percent range. the depreciation expense is $68,000. the tax rate is 32 percent. the sales price is estimated at $64 a unit, plus or minus 3 percent. what is the earnings before interest and taxes under the base case scenario?

Answers: 1

Business, 22.06.2019 01:20

For a multistate lottery, the following probability distribution represents the cash prizes of the lottery with their corresponding probabilities. complete parts (a) through (c) below. x (cash prize, $) p(x) grand prizegrand prize 0.000000008860.00000000886 200,000 0.000000390.00000039 10,000 0.0000016950.000001695 100 0.0001582930.000158293 7 0.0039114060.003911406 4 0.0080465690.008046569 3 0.012865710.01286571 0 0.975015928140.97501592814 (a) if the grand prize is $13 comma 000 comma 00013,000,000, find and interpret the expected cash prize. if a ticket costs $1, what is your expected profit from one ticket? the expected cash prize is $nothing.

Answers: 3

Business, 22.06.2019 07:00

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

You know the right answer?

Suppose you earned a $275,000 bonus this year and invested it at 8.25% per year. how much could you...

Questions

Mathematics, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

Social Studies, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

English, 17.08.2020 22:01

English, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

History, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

English, 17.08.2020 22:01

Biology, 17.08.2020 22:01

Biology, 17.08.2020 22:01

Mathematics, 17.08.2020 22:01

Social Studies, 17.08.2020 22:01

.............1

.............1