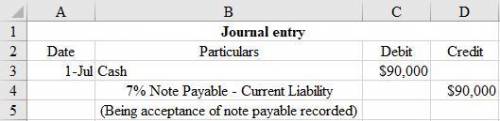

Graves company borrows $90,000 on july 1 from the bank by signing a $90,000, 7%, 1-year note payable.

prepare the journal entries to record the proceeds of the note. (credit account titles are automatically indented when amount is entered. do not indent manually.)

july 1

prepare the journal entries to record the accrued interest at december 31, assuming adjusting entries are made only at the end of the year. (round to 0 decimal places, e. g. 62. credit account titles are automatically indented when amount is entered. do not indent manually.)

decmber 31

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following best explains how the invention of money affected the barter system? a. the invention of money supplemented the barter system by providing a nonperishable medium of exchange b. the invention of money completely replaced the barter system with a free-market system c. the invention of money had no effect on the barter system d. the invention of money drastically reduced the value of goods used in the barter system 2b2t

Answers: 3

Business, 22.06.2019 10:00

Suppose an economy has only two sectors: goods and services. each year, goods sells 80% of its outputs to services and keeps the rest, while services sells 62% of its output to goods and retains the rest. find equilibrium prices for the annual outputs of the goods and services sectors that make each sector's income match its expenditures.

Answers: 2

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 22.06.2019 21:00

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

You know the right answer?

Graves company borrows $90,000 on july 1 from the bank by signing a $90,000, 7%, 1-year note payable...

Questions

Biology, 30.10.2020 20:10

English, 30.10.2020 20:10

Mathematics, 30.10.2020 20:10

History, 30.10.2020 20:10

Spanish, 30.10.2020 20:10

Mathematics, 30.10.2020 20:10

Mathematics, 30.10.2020 20:10

Mathematics, 30.10.2020 20:10