Business, 26.11.2019 20:31 fantasticjrod

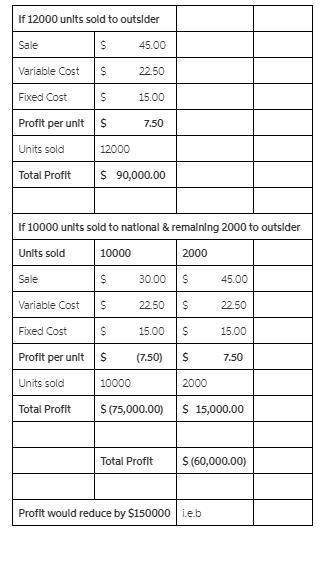

The national division of roboto company is buying 10,000 widgets from an outside supplier at $30 per unit. roboto's overseas division, which is producing and selling at full capacity (12,000 units), has the following sales and cost structure:

sales price per unit $45.00

variable cost per unit 22.50

fixed cost (at capacity) per unit 15.00

if the overseas division meets the outside supplier's price and sells the 10,000 widgets to national, the effect on overall company profits will be:

a. $75,000 higher

b. $225.000 lower

c. $300,000 higher

d. $150,000 lower

Answers: 3

Another question on Business

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 18:30

Amanufacturer has paid an engineering firm $200,000 to design a new plant, and it will cost another $2 million to build the plant. in the meantime, however, the manufacturer has learned of a foreign company that offers to build an equivalent plant for $2,100,000. what should the manufacturer do?

Answers: 1

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

Business, 22.06.2019 22:00

In which of the following games is it clearly the case that the cooperative outcome of the game is good for the two players and bad for society? a. two oil companies own adjacent oil fields over a common pool of oil, and each company decides whether to drill one well or two wells.b. two airlines dominate air travel between city a and city b, and each airline decides whether to charge a "high" airfare or a "low" airfare on flights between those two cities.c. two superpowers decide whether to build new weapons or to disarm.d. in all of the above cases, the cooperative outcome of the game is good for the two players and bad for society

Answers: 3

You know the right answer?

The national division of roboto company is buying 10,000 widgets from an outside supplier at $30 per...

Questions

World Languages, 25.06.2021 16:10

Biology, 25.06.2021 16:10

Mathematics, 25.06.2021 16:10

English, 25.06.2021 16:10

Spanish, 25.06.2021 16:10

Medicine, 25.06.2021 16:10

English, 25.06.2021 16:10