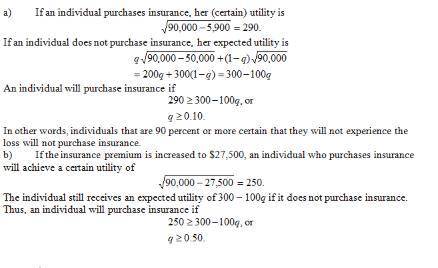

Consider a market of risk averse decision makers, each with a utility function u=√i each decision maker has an income of $90,000, but faces the possibility of a catastrophic loss of $50,000 in income. each decision maker can purchase an insurance policy that fully compensates her for her loss. this insurance policy has a cost of $5,900. suppose each decision maker potentially has a different probability p of experiencing the loss. a. what is the smallest value of p so that a decision maker purchases insurance? show your work. b. what would happen to this smallest value of p if the insurance company were to raise the insurance premium from $5,900 to $27,500?

Answers: 1

Another question on Business

Business, 21.06.2019 13:00

Druganaut company buys a $21,000 van on credit. the transaction will affect the

Answers: 3

Business, 21.06.2019 22:20

Outstanding stock consists of 8,300 shares of cumulative 7% preferred stock with a $10 par value and 4,300 shares of common stock with a $1 par value. during the first three years of operation, the corporation declared and paid the following total cash dividends. year dividend declared 2016 $ 0 2017 $ 7,300 2018 $ 45,000 the amount of dividends paid to preferred and common shareholders in 2018 is:

Answers: 2

Business, 22.06.2019 19:50

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

You know the right answer?

Consider a market of risk averse decision makers, each with a utility function u=√i each decision ma...

Questions

History, 04.03.2021 21:20

Social Studies, 04.03.2021 21:20

Mathematics, 04.03.2021 21:20

History, 04.03.2021 21:20

Mathematics, 04.03.2021 21:20

Arts, 04.03.2021 21:20

Chemistry, 04.03.2021 21:20

History, 04.03.2021 21:20

Mathematics, 04.03.2021 21:20

Mathematics, 04.03.2021 21:20

Physics, 04.03.2021 21:20

Mathematics, 04.03.2021 21:20

Chemistry, 04.03.2021 21:20