Business, 26.11.2019 05:31 ryantrajean7

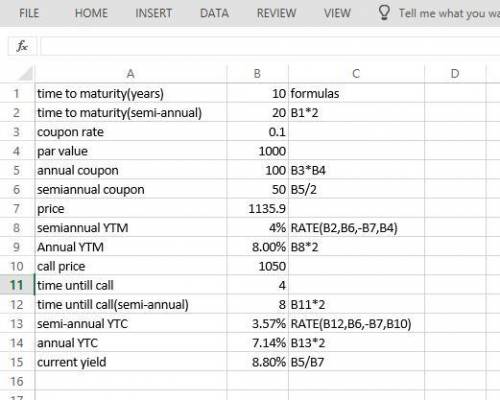

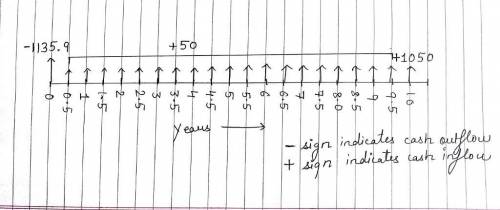

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (hint: par value is $1,000). draw the time line? show your work what is its yield to maturity (ytm)? show your work what s its current yield (cy)? show your work what is its yield to call (ytc)? show your work.

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

marketing strategies should be established before marketing objectives are decided. t/f

Answers: 1

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 13:30

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 23.06.2019 10:00

Each month hope received her bank statement listing the checks that have cleared her checking account in the month. what are these checks called? a. reconciled b. covered c. outstanding d. cancelled

Answers: 1

You know the right answer?

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (...

Questions

History, 13.12.2019 21:31

Computers and Technology, 13.12.2019 21:31

Social Studies, 13.12.2019 21:31

Biology, 13.12.2019 21:31

English, 13.12.2019 21:31

Mathematics, 13.12.2019 21:31

Mathematics, 13.12.2019 21:31

Physics, 13.12.2019 21:31

History, 13.12.2019 21:31

History, 13.12.2019 21:31