Business, 26.11.2019 05:31 maddyclark19

On january 1, 2018, the general ledger of grand finale fireworks includes the following account balances:

accounts debit credit

cash $ 43,200

accounts receivable 45,500

supplies 8,000

equipment 69,000

accumulated depreciation $ 9,500

accounts payable 15,100

common stock, $1 par value 15,000

additional paid-in capital 85,000

retained earnings 41,100

totals $ 165,700 $ 165,700

during january 2018, the following transactions occur:

january 2 issue an additional 2,000 shares of $1 par value common stock for $40,000.

january 9 provide services to customers on account, $15,600.

january 10 purchase additional supplies on account, $5,400.

january 12 repurchase 1,200 shares of treasury stock for $17 per share.

january 15 pay cash on accounts payable, $17,000.

january 21 provide services to customers for cash, $49,600.

january 22 receive cash on accounts receivable, $17,100.

january 29 declare a cash dividend of $0.30 per share to all shares outstanding on january 29. the dividend is payable on february 15. (hint: grand finale fireworks had 15,000 shares outstanding on january 1, 2018 and dividends are not paid on treasury stock.)

january 30 reissue 800 shares of treasury stock for $19 per share.

january 31 pay cash for salaries during january, $42,500.

1. record each of the transactions listed above.

a. unpaid utilities for the month of january are $6,700.

b. supplies at the end of january total $5,600.

c. depreciation on the equipment for the month of january is calculated using the straight-line method. at the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,500.

d. accrued income taxes at the end of january are $2,500.

2. record the adjusting entries on january 31, 2018 for the above transactions.

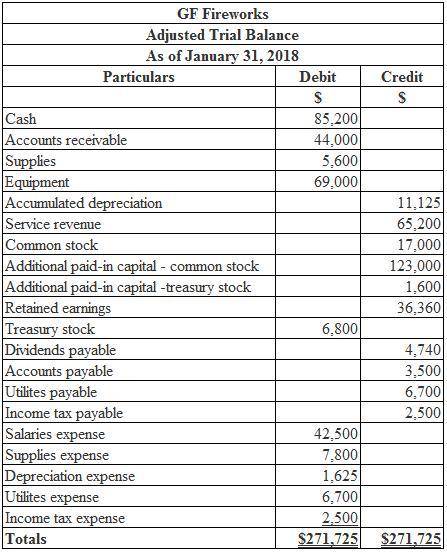

3. prepare an adjusted trial balance as of january 31, 2018.

4. prepare a multiple-step income statement for the period ended january 31, 2018.

5. prepare a classified balance sheet as of january 31, 2018.

on january 1, 2018, the general ledger of grand finale fireworks includes the following account balances: accounts debit credit cash $ 43,200 accounts receivable 45,500 supplies 8,000 equipment 69,000 accumulated depreciation $ 9,500 accounts payable 15,100 common stock, $1 par value 15,000 additional paid-in capital 85,000 retained earnings 41,100 totals $ 165,700 $ 165,700

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

What is the most important type of decision that the financial manager makes?

Answers: 2

Business, 22.06.2019 03:20

Yael decides that she no longer enjoys her job, and she quits to open a gluten-free, dairy-free kosher bakery. she pays a monthly rent for her store of $2,000. her labor costs for one month are $4,500, and she spends $6,000 a month on nut flours, sugar, and other supplies. yael was earning $2,500 a month working as a bank teller. these are her only costs. her monthly revenue is $14,000. which of the following statements about yael’s costs and profit are correct? correct answer(s) an accountant would say she is earning a monthly profit of $1,500. her implicit costs are $2,500 a month. an economist would tell her that she is experiencing a loss. her total costs are $12,500 a month. her explicit costs include the labor, rent, and supplies for her store. her economic profit is $1,500 a month.

Answers: 3

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 23.06.2019 10:00

At the beginning of each month, desmond receives a written statement from his bank containing all the transactions processed on his checking account for the previous month desmond compares his check register to this bank statement. this comparison is known as your account. a. confirming b. reconciling c. comparing d. finalizing

Answers: 1

You know the right answer?

On january 1, 2018, the general ledger of grand finale fireworks includes the following account bala...

Questions

Mathematics, 01.07.2021 05:30

Mathematics, 01.07.2021 05:30

History, 01.07.2021 05:30

Mathematics, 01.07.2021 05:40

Biology, 01.07.2021 05:40

Biology, 01.07.2021 05:40

Mathematics, 01.07.2021 05:40

Advanced Placement (AP), 01.07.2021 05:40

Chemistry, 01.07.2021 05:40

History, 01.07.2021 05:40

Mathematics, 01.07.2021 05:40

English, 01.07.2021 05:40