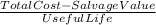

Infinity corporation purchased equipment with a 10-year useful life and zero residual value for $10,000. at the end of the fifth year, the equipment is sold for $6,000. the entry to record this sale will include? assume the straight-line depreciation method is used. select all that apply. a. a credit to loss for $1,000b. a credit to gain for $6,000c. a debit to equipment for $6,000d. a credit to equipment for $10,000e. a debit to cash for $6,000f. a debit to accumulated depreciation for $5,000g. a credit to gain for $1,000

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Using the exxon data as an example what would be the market capitalization of penny's pickles if each share is selling for $175.35?

Answers: 3

Business, 22.06.2019 11:50

What is marketing’s contribution to the new product development team? a. technical expertise needed to translate designs into an actual product/service. b. deep customer insight that leads to product ideas. c. ability to assess financial viability d. feedback on design as well as how customers will actually use the product e. technical expertise needed to translate concepts into product/service designs.

Answers: 2

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Business, 22.06.2019 20:50

Which of the following statements regarding the southern economy at the end of the nineteenth century is accurate? the south was producing as much cotton as it had before the civil war.

Answers: 3

You know the right answer?

Infinity corporation purchased equipment with a 10-year useful life and zero residual value for $10,...

Questions

Mathematics, 20.11.2021 14:20

Computers and Technology, 20.11.2021 14:20

Mathematics, 20.11.2021 14:30

Social Studies, 20.11.2021 14:30

History, 20.11.2021 14:30

Mathematics, 20.11.2021 14:30

Mathematics, 20.11.2021 14:30