Business, 24.11.2019 22:31 kyramillerr8639

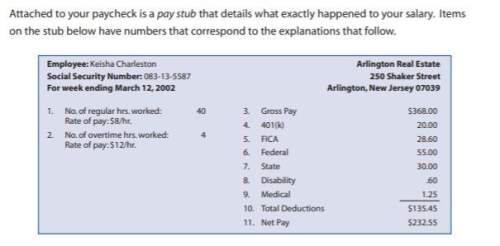

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these hours. here, 40 hours x $8/hr. = 320.00

2. employers usually pay one-and-a-half time the standard hourly rate for any hours over 40 that are worked. half of $8 is $4 so the overtime rate is $8+4$=$12. keisha's overtime pay is 4 hours x $12/hr. = 48.00

3. gross pay is total earnings (standard and overtime) before taxes and deductions. gross pay in the case is $320.00 + $48.00 = $368.00

4. 401(k) is a retirement account contribution that is tax-free until your retire. for the year 2003, individuals 50 years or older can contribute up to a maximum of 13,000 to this fund annually. individuals under the age for 50 can contribute up to 12,000

5. fica stands for federal insurance contribution act. this is the money that is deducted and put into your social security fund. your social security fund holds a percentage of your earnings averaged over most of your working lifetime. social security was never intended to be your only source of income when you retire or become disabled, or your family's only income if you die. it is intended to supplement other income you have from pension plans, saving investments, etc. currently, each one of your paychecks will be reduced by 7.65% specifically for your fica contribution. your employer is required by law to match this same amounr and pay it to social security

Answers: 1

Another question on Business

Business, 22.06.2019 03:10

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 12:10

Gwen, a manager at exude apparels inc., received a message from a customer requesting a replacement for a purchased pair of shoes. exude apparels has a clearly stated no-return policy. gwen responded to the customer denying the request in a tactful and clear manner. despite this, the customer submitted a second request. in this scenario, which of the following is an appropriate response to the second request?

Answers: 2

Business, 22.06.2019 20:00

Modern firms increasingly rely on other firms to supply goods and services instead of doing these tasks themselves. this increased level of is leading to increased emphasis on management.

Answers: 2

You know the right answer?

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these...

Questions

English, 07.05.2021 01:00

Biology, 07.05.2021 01:00

Chemistry, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00