Business, 23.11.2019 00:31 michellen2020

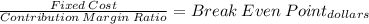

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the company’s income statement showed the following results from selling 77,000 units of product: net sales $2,310,000; total costs and expenses $1,944,000; and net loss $366,000. costs and expenses consisted of the following. total variable fixed cost of goods sold $1,275,000 $774,000 $501,000 selling expenses 520,000 94,000 426,000 administrative expenses 149,000 56,000 93,000 $1,944,000 $924,000 $1,020,000 management is considering the following independent alternatives for 2017. 1. increase unit selling price 25% with no change in costs and expenses. 2. change the compensation of salespersons from fixed annual salaries totaling $197,000 to total salaries of $40,000 plus a 5% commission on net sales. 3. purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50: 50. (a) compute the break-even point in dollars for 2016. (round contribution margin ratio to 2 decimal places e. g. 0.25 and final answer to 0 decimal places, e. g. 2,510.) break-even point $ (b) compute the break-even point in dollars under each of the alternative courses of action for 2017. (round contribution margin ratio to 4 decimal places e. g. 0.2512 and final answers to 0 decimal places, e. g. 2,510.)

Answers: 3

Another question on Business

Business, 22.06.2019 02:40

Which critical success factor improves with reduced cycle time, better quality standards, and improved efficiency when an is is implemented?

Answers: 3

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

You know the right answer?

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the...

Questions

Mathematics, 27.07.2019 03:30

Mathematics, 27.07.2019 03:30

Mathematics, 27.07.2019 03:30

Health, 27.07.2019 03:30

Social Studies, 27.07.2019 03:40

History, 27.07.2019 03:40

Mathematics, 27.07.2019 03:40