Business, 22.11.2019 23:31 swallowcaroline11

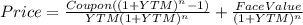

Adidas issued 10-year, 8% bonds with a par value of $200,000. interest is paid semiannually. the market rate on the issue date was 7.5%. adidas received $206,948 in cash proceeds. which of the following statements is true? a. adidas must pay $200,000 at maturity plus 20 interest payments of $8,000 each. b. adidas must pay $206,948 at maturity plus 20 interest payments of $8,000 each. c. adidas must pay $200,000 at maturity plus 20 interest payments of $7,500 each. d. adidas must pay $200,000 at maturity and no interest payments. e. adidas must pay $206,948 at maturity and no interest payments.

Answers: 3

Another question on Business

Business, 22.06.2019 00:10

What are the forecasted levels of the line of credit and special dividends? (hints: create a column showing the ratios for the current year; then create a new column showing the ratios used in the forecast. also, create a preliminary forecast that doesn’t include any new line of credit or special dividends. identify the financing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any new line of credit or special dividend.) now assume that the growth in sales is only 3%. what are the forecasted levels of the line of credit and special dividends?

Answers: 1

Business, 22.06.2019 01:20

As a project manager for a large construction company, shaun decided to make the performance appraisal process as painless as possible for his crew. he spent a considerable amount of time creating performance standards he felt were reasonable, and after six months' time, he scheduled individual appointments with each worker to discuss strengths and weaknesses and areas that needed improvement according to the standards he privately set. some employees were sent to vestibule training, and one even got a promotion with additional compensation. what did he fail to do correctly

Answers: 2

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

You know the right answer?

Adidas issued 10-year, 8% bonds with a par value of $200,000. interest is paid semiannually. the mar...

Questions

Mathematics, 07.12.2020 21:00

History, 07.12.2020 21:00

English, 07.12.2020 21:00

Physics, 07.12.2020 21:00

Computers and Technology, 07.12.2020 21:00

Social Studies, 07.12.2020 21:00

Arts, 07.12.2020 21:00

English, 07.12.2020 21:00

Geography, 07.12.2020 21:00

Mathematics, 07.12.2020 21:00