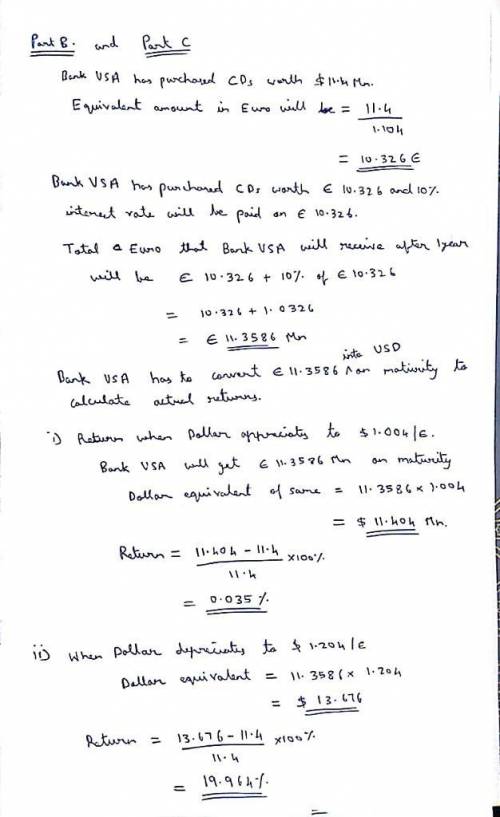

Bank usa recently purchased $11.4 million worth of euro-denominated one-year cds that pay 10 percent interest annually. the current spot rate of u. s. dollars for euros is $1.104/€1. a. is bank usa exposed to an appreciation or depreciation of the dollar relative to the euro? b. what will be the return on the one-year cd if the dollar appreciates relative to the euro such that the spot rate of u. s. dollars for euros at the end of the year is $1.004/€1? (round your answer to 3 decimal places. (e. g., 32.161)) c. what will be the return on the one-year cd if the dollar depreciates relative to the euro such that the spot rate of u. s. dollars for euros at the end of the year is $1.204/€1? (round your answer to 3 decimal places. (e. g., 32.161))

Answers: 2

Another question on Business

Business, 21.06.2019 13:50

2. a box contains 50 slips of paper. forty of the slips are marked $0, 8 of the slips are marked $20, 1 slip is marked $100, and the last one is marked $500. find the expected net winnings of a person who pays $10 to randomly select one slip of paper. interpret.

Answers: 1

Business, 21.06.2019 21:00

Colah company purchased $1.8 million of jackson, inc. 8% bonds at par on july 1, 2018, with interest paid semi-annually. when the bonds were acquired colah decided to elect the fair value option for accounting for its investment. at december 31, 2018, the jackson bonds had a fair value of $2.08 million. colah sold the jackson bonds on july 1, 2019 for $1,620,000. the purchase of the jackson bonds on july 1. interest revenue for the last half of 2018. any year-end 2018 adjusting entries. interest revenue for the first half of 2019. any entry or entries necessary upon sale of the jackson bonds on july 1, 2019. required: 1. prepare colah's journal entries for above transaction.

Answers: 1

Business, 22.06.2019 00:30

Norton manufacturing expects to produce 2,900 units in january and 3,600 units in february. norton budgets $20 per unit for direct materials. indirect materials are insignificant and not considered for budgeting purposes. the balance in the raw materials inventory account (all direct materials) on january 1 is $38,650. norton desires the ending balance in raw materials inventory to be 10% of the next month's direct materials needed for production. desired ending balance for february is $51,100. what is the cost of budgeted purchases of direct materials needed for january? $58,000 $65,200 $26,550 $25,150

Answers: 1

Business, 22.06.2019 05:00

Every 10 years, the federal government sponsors a national survey of health and health practices (nhanes). one question in the survey asks participants to rate their overall health using a 5-point rating scale. what is the scale of measurement used for this question? ratio ordinal interval nominal

Answers: 1

You know the right answer?

Bank usa recently purchased $11.4 million worth of euro-denominated one-year cds that pay 10 percent...

Questions

Mathematics, 22.08.2019 11:10

History, 22.08.2019 11:10

Geography, 22.08.2019 11:10

History, 22.08.2019 11:10

Health, 22.08.2019 11:10

Mathematics, 22.08.2019 11:10

English, 22.08.2019 11:20

History, 22.08.2019 11:20