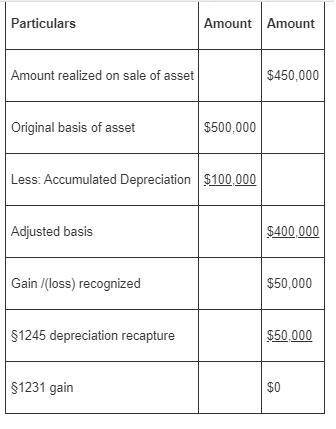

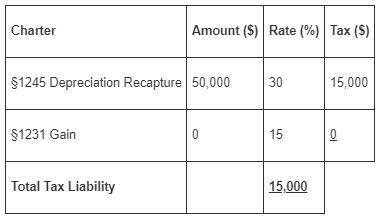

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deductions against the asset. hart has a marginal tax rate of 32 percent. answer the questions presented in the following alternative scenarios (assume hart had no property transactions other than those described in the problem): (loss amounts should be indicated by a minus sign. enter na if a situation is not applicable. leave no answer blank. enter zero if applicable.) required: a1. what is the amount and character of hart’s recognized gain or loss if the asset is tangible personal property sold for $450,000? a2. due to this sale, what tax effect does hart have for the year?

Answers: 3

Another question on Business

Business, 21.06.2019 13:30

In the second column, determine if penguin patties are a complement to or a substitute for each of the goods listed. finally, complete the final column by indicating which good you should recommend marketing with penguin patties.

Answers: 3

Business, 22.06.2019 18:00

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

Business, 22.06.2019 21:00

Describe what fixed costs and marginal costs mean to a company.

Answers: 1

Business, 22.06.2019 23:50

Melissa buys an iphone for $240 and gets consumer surplus of $160. a. what is her willingness to pay? b. if she had bought the iphone on sale for $180, what would her consumer surplus have been?

Answers: 3

You know the right answer?

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deduction...

Questions

Biology, 12.08.2021 23:00

Mathematics, 12.08.2021 23:00

Engineering, 12.08.2021 23:00

Mathematics, 12.08.2021 23:00

History, 12.08.2021 23:10

History, 12.08.2021 23:10

Mathematics, 12.08.2021 23:10

Mathematics, 12.08.2021 23:10

Geography, 12.08.2021 23:10