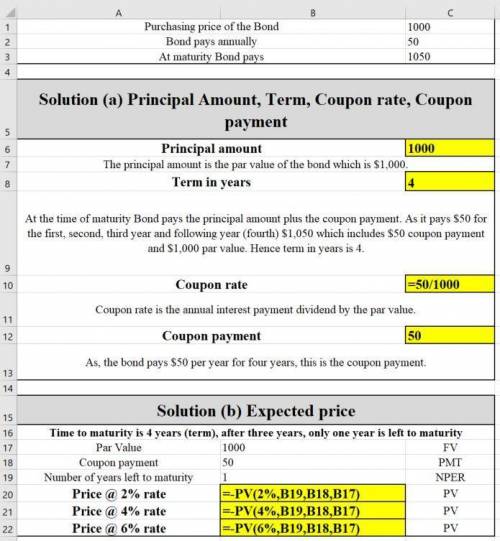

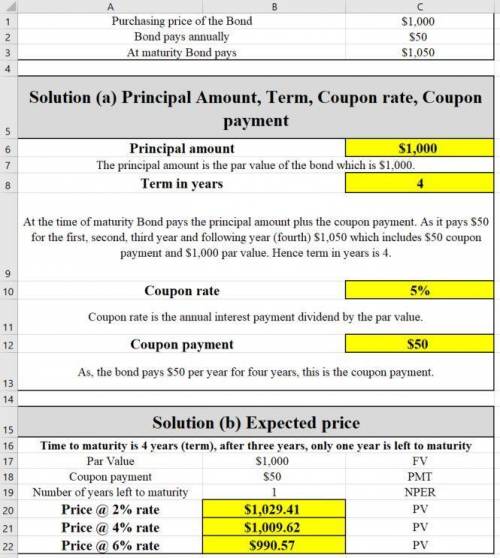

You have just purchased a newly issued municipal bond for $1,000. the bond pays $50 to its holder at the end of the the first, second, and third years and pays $1,050 upon its maturity at the end of the following year. a. what are the principal amount, the term, the coupon rate, and the coupon payment for your bond? instructions: enter your responses as whole numbers. principal amount: $ term: years coupon rate: % coupon payment: $ b. if you decide to sell your bond at the end of 3 years (after receiving the third $50 payment), what price can you expect for your bond if the one-year interest rate at that time is 2 percent? 4 percent? 6 percent? instructions: enter your responses as whole numbers. expected price for the bond at: 2 percent: $ 4 percent: $ 6 percent: $

Answers: 3

Another question on Business

Business, 22.06.2019 13:40

Computing equivalent units is especially important for: (a) goods that take a relatively short time to produce, such as plastic bottles. (b) goods with sustainability implications in their production processes. (c) goods that are started and completed during the same period. (d) goods that take a long time to produce, such as airplanes.

Answers: 2

Business, 22.06.2019 17:50

The management of a supermarket wants to adopt a new promotional policy of giving a free gift to every customer who spends > a certain amount per visit at this supermarket. the expectation of the management is that after this promotional policy is advertised, the expenditures for all customers at this supermarket will be normally distributed with a mean of $95 and a standard deviation of $20. if the management wants to give free gifts to at most 10% of the customers, what should the amount be above which a customer would receive a free gift?

Answers: 1

Business, 22.06.2019 23:30

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

Business, 22.06.2019 23:30

What are consequences of rapid inflation? (select all that apply.) savings accounts become less desirable because interest earned is lower than inflation individual purchasing power increases, which results in an increase in demand. individual purchasing power decreases, which results in a decrease in demand. people postpone purchasing expensive items, such as homes, until prices drop.

Answers: 1

You know the right answer?

You have just purchased a newly issued municipal bond for $1,000. the bond pays $50 to its holder at...

Questions

History, 16.11.2019 12:31

Mathematics, 16.11.2019 12:31

Business, 16.11.2019 12:31

English, 16.11.2019 12:31

Mathematics, 16.11.2019 12:31

Mathematics, 16.11.2019 12:31

Mathematics, 16.11.2019 12:31