Business, 19.11.2019 23:31 juansantos7b

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports business income of $394,000 and business deductions of $689,500, resulting in a loss of $295,500. what are the implications of this business loss?

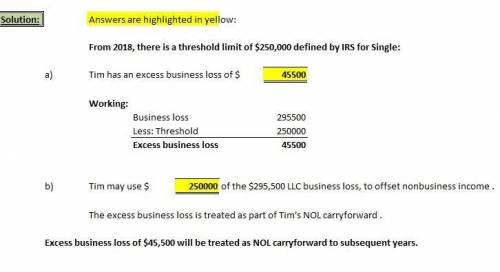

tim has an excess business loss of $

can this business loss be used to offset other income that tim reports? if so, how much? if not, what happens to the loss?

tim may use $ of the $295,500 llc business loss, to offset nonbusiness income . the excess business loss is treated as part of tim's nol carryforward .

Answers: 1

Another question on Business

Business, 21.06.2019 22:20

Why should you not sign the tenant landlord agreement quickly and immediately

Answers: 1

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

Business, 22.06.2019 19:00

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill.

Answers: 1

Business, 22.06.2019 19:40

Banana computers has decided to procure processing chips required for its laptops from external suppliers instead of manufacturing them in their own facilities. how will this decision affect the firm? a. the firm will be protected against the principal-agent problem. b. the firm's administrative costs will be low because of necessary bureaucracy. c. the firm will have more flexibility in purchasing and comparing prices of goods and services. d. the firm will have high-powered incentives, such as hourly wages and salaries.

Answers: 3

You know the right answer?

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports busines...

Questions

Mathematics, 13.07.2019 09:30

Social Studies, 13.07.2019 09:30

English, 13.07.2019 09:30

Biology, 13.07.2019 09:30

Social Studies, 13.07.2019 09:30

Mathematics, 13.07.2019 09:30

Biology, 13.07.2019 09:30

Mathematics, 13.07.2019 09:30

Mathematics, 13.07.2019 09:30

Social Studies, 13.07.2019 09:30

History, 13.07.2019 09:30