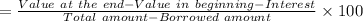

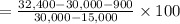

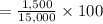

You are bullish on telecom stock. the current market price is $100 per share, and you have $15,000 of your own to invest. you borrow an additional $15,000 from your broker at an interest rate of 6.0% per year and invest $30,000 in the stock. a. what will be your rate of return if the price of telecom stock goes up by 8% during the next year? (ignore the expected dividend.) (round your answer to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 15:30

Susan is a 5th grade teacher and loves getting up every day and going to work to teach her students. this is an example of a. extrinsic value b. interests c. intrinsic value d. external value

Answers: 2

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

Business, 23.06.2019 00:00

In this multi-channel funnel report, which two channels have the highest overlap and would benefit from coordinated marketing messaging?

Answers: 2

Business, 23.06.2019 00:30

In a recent annual report, apple computer reported the following in one of its disclosure notes: "warranty expense: the company provides currently for the estimated cost for product warranties at the time the related revenue is recognized." this note exemplifies apple's use of: (a) conservatism.(b) matching. (c) realization principle. (d) economic entity.

Answers: 2

You know the right answer?

You are bullish on telecom stock. the current market price is $100 per share, and you have $15,000 o...

Questions

Business, 31.01.2020 18:50

Social Studies, 31.01.2020 18:50

Mathematics, 31.01.2020 18:50

French, 31.01.2020 18:50

Mathematics, 31.01.2020 18:51

Mathematics, 31.01.2020 18:51