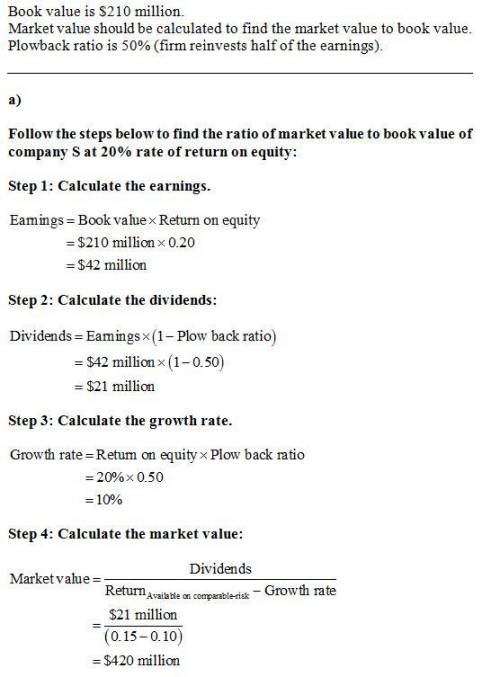

Start-up industries is a new firm that has raised $210 million by selling shares of stock. management plans to earn a 20% rate of return on equity, which is more than the 15% rate of return available on comparable-risk investments. half of all earnings will be reinvested in the firm. a.what will be start-up’s ratio of market value to book value? (do not round intermediate calculations.)market-to-book ratio b. what will be start-up’s ratio of market value to book value if the firm can earn only a rate of return of 10% on its investments? (do not round intermediate calculations. round your answer to 2 decimal places.)market-to-book ratio

Answers: 1

Another question on Business

Business, 22.06.2019 10:50

Explain whether each of the following events increases, decreases, or has no effect on the unemployment rate and the labor-force participation rate.a. after a long search, jon finds a job.b. tyrion, a full-time college student, graduates and is immediately employed.c. after an unsuccessful job search, arya gives up looking and retires.d. daenerys quits her job to become a stay-at-home mom.e. sansa has a birthday, becomes an adult, but has no interest in working.f. jaime has a birthday, becomes an adult, and starts looking for a job.g. cersei dies while enjoying retirement.h. jorah dies working long hours at the office.

Answers: 2

Business, 22.06.2019 12:30

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 23.06.2019 05:10

Lakota is buying a new laptop. he wants to use google as his main search engine. he should be sure which internet browser(s) are loaded on his computer?

Answers: 2

You know the right answer?

Start-up industries is a new firm that has raised $210 million by selling shares of stock. managemen...

Questions

Advanced Placement (AP), 09.11.2019 03:31

History, 09.11.2019 03:31

Mathematics, 09.11.2019 03:31

Mathematics, 09.11.2019 03:31

Mathematics, 09.11.2019 03:31

Mathematics, 09.11.2019 03:31

Mathematics, 09.11.2019 03:31

Engineering, 09.11.2019 03:31

Geography, 09.11.2019 03:31