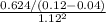

Microsoft presently pays no dividend. you anticipate microsoft will pay an annual dividend of $0.60 per share two years from today and you expect dividends to grow by 4% per year thereafter. if microsoft's equity cost of capital is 12%, then the value of a share of microosfoft today is:

(a) $6.70

(b) $6.90

(c) $5.00

(d) $6.25

Answers: 2

Another question on Business

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 22.06.2019 22:00

Which of the following is a function performed by market prices? a. market prices communicate information to buyers and sellers. b. market prices coordinate the decisions of buyers and sellers. c. market prices motivate entrepreneurs to produce those products that are currently most desired relative to their costs of production. d. all of the above are functions performed by market prices.

Answers: 2

Business, 23.06.2019 00:30

One of the growers is excited by this advancement because now he can sell more crops, which he believes will increase revenue in this market. as an economics student, you can use elasticities to determine whether this change in price will lead to an increase or decrease in total revenue in this market. using the midpoint method, the price elasticity of demand for soybeans between the prices of $5 and $4 per bushel is , which means demand is between these two points. therefore, you would tell the grower that his claim is because total revenue will as a result of the technological advancement.

Answers: 1

You know the right answer?

Microsoft presently pays no dividend. you anticipate microsoft will pay an annual dividend of $0.60...

Questions

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Computers and Technology, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40

Mathematics, 25.01.2021 02:40