Your company, which has a marr of 12%, is considering the following two investment alternatives:

- project a project b

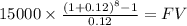

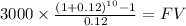

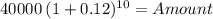

initial capital investment $40,000 $60,000

revenues $15,000 per year, $24,000 per year

starting in year 3 starting in year 4

expenses $3,000 per year $3,000 per year

salvage value $4,000 $9,000

project life 10 years 10 years

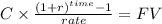

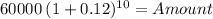

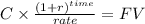

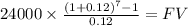

a) find the future worth of project a and project b.

b) determine which project, if any, your company should choose.

c) find the irr of project a.

Answers: 1

Another question on Business

Business, 22.06.2019 08:10

The sec has historically raised questions regarding the independence of firms that derive a significant portion of their total revenues from one audit client or group of clients because the sec staff believes this situation causes cpa firms to

Answers: 3

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 12:30

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 22.06.2019 21:50

Which of the following best describes the economic effect that results from the government having a budget surplus? a. consumers save more and spend less, enabling long-term financial planning. b. overall demand decreases, reducing the incentive for producers to increase production. c. banks have more deposits, enabling them to make more loans to investors. d. government spending increases, increasing competition for goods and services and driving prices up.

Answers: 3

You know the right answer?

Your company, which has a marr of 12%, is considering the following two investment alternatives:

Questions

Health, 16.11.2020 06:20

English, 16.11.2020 06:20

Mathematics, 16.11.2020 06:20

Mathematics, 16.11.2020 06:20

History, 16.11.2020 06:20

World Languages, 16.11.2020 06:20

History, 16.11.2020 06:20

History, 16.11.2020 06:20

Geography, 16.11.2020 06:20

Mathematics, 16.11.2020 06:20

History, 16.11.2020 06:20

Mathematics, 16.11.2020 06:20