Business, 12.11.2019 00:31 tajanaewilliams77

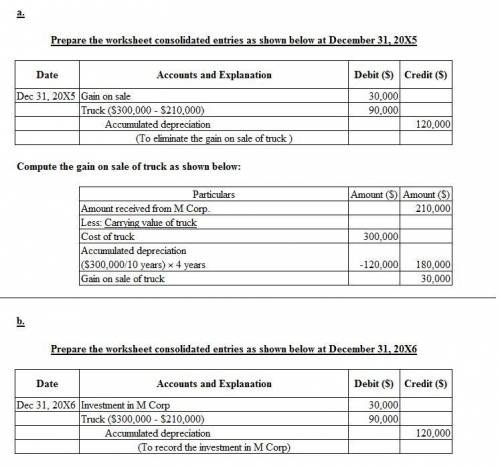

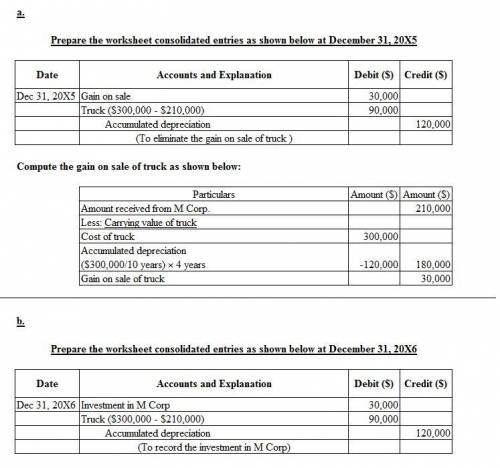

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20x1, at underlying book value. on january 1, 20x5, frazer received $210,000 from minnow for a truck frazer had purchased on january 1, 20x2, for $300,000. the truck is expected to have a 10-year useful life and no salvage value. both companies depreciate trucks on a straight-line basis.

required

a. give the workpaper eliminating entry or entries needed at december 31, 20x5, to remove the effects of the intercompany sale.

b. give the workpaper eliminating entry or entries needed at december 31, 20x6, to remove the effects of the intercompany sale.

Answers: 2

Another question on Business

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 13:00

The green revolution is a scientific breakthrough that improved seeds for basic crops. how did the green revolution impact the supply of basic crops such as wheat and corn? the supply of wheat and corn increased. there was no impact on the supply of basic crops. the supply of basic crops did not change, but the quantity supplied of basic crops increased. the supply of wheat and corn decreased.

Answers: 3

Business, 23.06.2019 07:50

Aeuropean aircraft producer has spent 15 years in developing a new aircraft that would potential threaten long-lasting boeing's dominance (monopoly) in the same class of aircrafts. the new european aircraft gets high marks on all performance measures except noise. because of the noise, the european producers management is concerned that the us government may impose restrictions which would forbid their aircraft to land in some of the american airports. without restrictions the estimated (present discounted) profit would be 125 million usd. with the restrictions the profit would only be 25 million usd. the chances of both outcomes are estimated to be 50-50. management must decide now whether to the cost of redesign program problem and a 60% chance it will fail. should the european aircraft producer start the noise redesign program if they do not have any redesign parts of the aircraft to solve the noise problem. is 25 million usd. there is a 40% chance that redesign will solve the noise additional information than mentioned above? draw the decision tree, indicate probabilities and outcomes of the events * imagine that the company could find out in advance the outcome of the u.s. government's e find the expected value of perfect information about the u.s. government's decision. decision. draw a new decision tree, indicate probabilities and outcomes of the events.

Answers: 3

Business, 23.06.2019 11:00

What is considered to be a significant disadvantage of owning

Answers: 3

You know the right answer?

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20...

Questions

Arts, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

History, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

Physics, 12.11.2020 01:00

Physics, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00

Mathematics, 12.11.2020 01:00