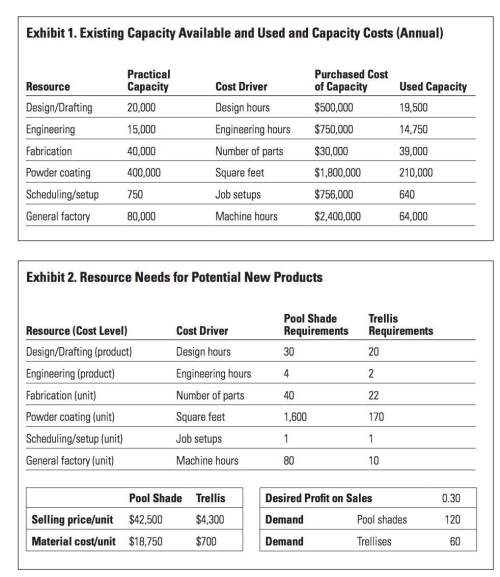

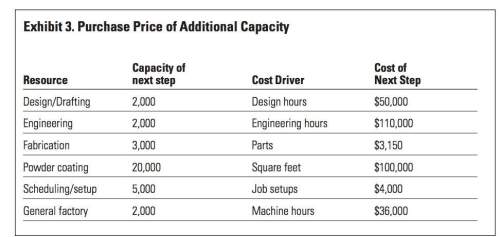

Resource spending approach: assume the decisions to make pool shades and trellises are considered to be a short-term decision and that chandler would make these products one at a time when time is available, so as not to not delay any of the custom orders. because there is excess capacity on current production equipment, the company wants to use a tactical decision (resource spending) approach to evaluate the decision to make the products. exhibit 3 provides information about the cost to purchase additional resources. a. compute the net change in cash flow of making and selling the full demand of pool shades. b. compute the net change in cash flow of making and selling the full demand of trellises. c. compute the net change in cash flow of making the full demand for both the pool shades and the trellises. d. given the assumptions aforementioned (such as short-term and excess capacity), would chandler’s management choose to make either or both of the products? explain your answer.

Answers: 3

Another question on Business

Business, 21.06.2019 17:30

If you want to compare two different investments, what should you calculate

Answers: 2

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

You know the right answer?

Resource spending approach: assume the decisions to make pool shades and trellises are considered t...

Questions

SAT, 28.12.2021 02:30

SAT, 28.12.2021 02:30

History, 28.12.2021 02:40

Chemistry, 28.12.2021 02:40

SAT, 28.12.2021 02:40

Advanced Placement (AP), 28.12.2021 02:40