Business, 10.11.2019 06:31 luzcastellanos556

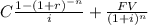

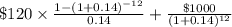

$250 million bond issue to finance the purchase of new jet airliners. these bonds were issued in $1000 denominations with an original maturity of 12 years and a coupon rate of 12%. determine the value today of one of these bonds to an investor who requires a 14% rate of return on these securities.

Answers: 1

Another question on Business

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 07:30

An important application of regression analysis in accounting is in the estimation of cost. by collecting data on volume and cost and using the least squares method to develop an estimated regression equation relating volume and cost, an accountant can estimate the cost associated with a particular manufacturing volume. consider the following sample of production volumes and total cost data for a manufacturing operation. production volume (units) total cost ($) 400 4000 450 5000 550 5400 600 5900 700 6400 750 7000 compute b 1 and b 0 (to 2 decimals if necessary). b 1 b 0 complete the estimated regression equation (to 2 decimals if necessary). = + x what is the variable cost per unit produced (to 1 decimal)? $ compute the coefficient of determination (to 4 decimals). note: report r 2 between 0 and 1. r 2 = what percentage of the variation in total cost can be explained by the production volume (to 2 decimals)? % the company's production schedule shows 500 units must be produced next month. what is the estimated total cost for this operation (to 2 decimals)? $

Answers: 1

Business, 22.06.2019 08:00

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

You know the right answer?

$250 million bond issue to finance the purchase of new jet airliners. these bonds were issued in $10...

Questions

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Physics, 10.09.2020 09:01

Health, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

History, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01