Business, 10.11.2019 03:31 brittany7436

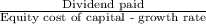

Laurel enterprises expects earnings next year of $4.06 per share and has a 40 % retention rate, which it plans to keep constant. its equity cost of capital is 9 %, which is also its expected return on new investment. its earnings are expected to grow forever at a rate of 3.6 % per year. if its next dividend is due in one year, what do you estimate the firm's current stock price to be?

Answers: 3

Another question on Business

Business, 21.06.2019 16:00

Straight arrow unloaded two tankers worth of toxic waste at an important port in the country of urithmea. a hundred workers worked two days in their shorts and sandals to unload the barrels from the tankers for $5 a day. they were not told about the content of the barrels. some observers felt that it was the obligation of not just the government of urithmea but also of straight arrow to ensure that no harm was done to the workers. these observers are most likely

Answers: 2

Business, 21.06.2019 20:30

Which of the following statements is correct? a) one drawback of forming a corporation is that it generally subjects the firm to additional regulationsb) one drawback of forming a corporation is that it subjects the firms investors to increased personal liabilitiesc) one drawback of forming a corporation is that it makes it more difficult for the firm to raise capitald) one advantage of forming a corporation is that it subjects the firm's investors to fewer taxese) one disadvantage of forming a corporation is that it is more difficult for the firm's investors to transfer their ownership interests

Answers: 1

Business, 22.06.2019 11:00

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 13:30

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

You know the right answer?

Laurel enterprises expects earnings next year of $4.06 per share and has a 40 % retention rate, whic...

Questions

Mathematics, 18.11.2020 14:00

Chemistry, 18.11.2020 14:00

Physics, 18.11.2020 14:00

Chemistry, 18.11.2020 14:00

Biology, 18.11.2020 14:00

SAT, 18.11.2020 14:00

Chemistry, 18.11.2020 14:00

Chemistry, 18.11.2020 14:00

Social Studies, 18.11.2020 14:00

English, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

Business, 18.11.2020 14:00

Biology, 18.11.2020 14:00