Business, 08.11.2019 07:31 Sfowler5129

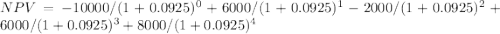

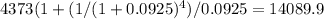

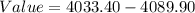

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $10,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of years 1 and 2, respectively. project l has an expected life of 4 years with after-tax cash inflows of $4,373 at the end of each of the next 4 years. each project has a wacc of 9.25%, and project s can be repeated with no changes in its cash flows. the controller prefers project s, but the cfo prefers project l. how much value will the firm gain or lose if project l is selected over project s, i. e., what is the value of npvl - npvs? a. $56.50b. $62.15c. $68.37d. $75.21e. $82.73

Answers: 3

Another question on Business

Business, 21.06.2019 17:40

Sodas in a can are supposed to contain an average of 12 ounces. this particular brand has a standard deviation of 0.1 ounces, with an average of 12.1 ounces. if the can's contents follow a normal distribution, what is the probability that the mean contents of a six pack are less than 12 ounces?

Answers: 2

Business, 22.06.2019 21:50

Assume that (i) setups need to be completed first; (ii) a setup can only start once the batch has arrived at the resource, and (iii) all flow units of a batch need to be processed at a resource before any of the units of the batch can be moved to the next resource. process step 1 molding 2 painting 3 dressing setup time 15 min. 30 min. no setup processing time 0.25 min./unit 0.15 min./unit 0.30 min./unit which batch size would minimize inventory without decreasing the process capacity?

Answers: 1

Business, 22.06.2019 23:30

Shelby bought her dream car, a 1966 red convertible mustang, with a loan from her credit union. if shelby paid 5.1% and the bank earned a real rate of return of 3.5%, what was the inflation rate over the life of the loan?

Answers: 2

Business, 23.06.2019 00:00

Wo firms, a and b, each currently dump 50 tons of chemicals into the local river. the government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river. it costs firm a $100 for each ton of pollution that it eliminates before it reaches the river, and it costs firm b $50 for each ton of pollution that it eliminates before it reaches the river. the government gives each firm 20 pollution permits. government officials are not sure whether to allow the firms to buy or sell the pollution permits to each other. what is the total cost of reducing pollution if firms are not allowed to buy and sell pollution permits from each other? what is the total cost of reducing pollution if the firms are allowed to buy and sell permits from each other? a. $3,000; $1,500 b. $4,500; $3,500 c. $4,500; $4,000 d. $4,500; $2,500

Answers: 3

You know the right answer?

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $1...

Questions

Physics, 17.04.2020 22:15

Social Studies, 17.04.2020 22:15

World Languages, 17.04.2020 22:15

Mathematics, 17.04.2020 22:15

Mathematics, 17.04.2020 22:15

Social Studies, 17.04.2020 22:15

Mathematics, 17.04.2020 22:15

Social Studies, 17.04.2020 22:15