Business, 08.11.2019 07:31 hardwick744

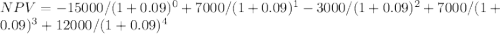

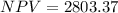

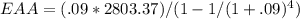

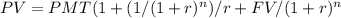

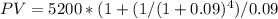

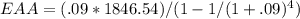

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $15,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of years 1 and 2, respectively. in addition, project s can be repeated at the end of year 2 with no changes in its cash flows. project l has an expected life of 4 years with after-tax cash inflows of $5,200 at the end of each of the next 4 years. each project has a wacc of 9.00%. what is the equivalent annual annuity of the most profitable project? a. $ 569.97b. $ 782.34c. $ 865.31d. $1,522.18e. $1,846.54

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 23.06.2019 08:40

One principle of usability testing is that it permeates product development. what does that mean?

Answers: 3

Business, 23.06.2019 19:30

How might a recent college graduate's investment portfolio differ from someone who is near retirement

Answers: 1

Business, 23.06.2019 20:30

The custom foot is a shoe store chain that manufactures shoes and allows customers to design a unique product by selecting from the type of leather, color, design, and size. this is an example of

Answers: 1

You know the right answer?

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $...

Questions

Spanish, 07.07.2019 01:30

Spanish, 07.07.2019 01:30

World Languages, 07.07.2019 01:30

English, 07.07.2019 01:30

Computers and Technology, 07.07.2019 01:30

Chemistry, 07.07.2019 01:30

Biology, 07.07.2019 01:30

English, 07.07.2019 01:30