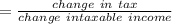

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has the opportunity to earn an additional $5,000 if she accepts and completes a special project at work. there are no additional expenses to offset the $5,000 income. consequently, arlene will have a tax liability of $2,986 if she accepts the special project. arlene has a marginal tax rate of

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

The leading producer of cell phone backup batteries, jumpstart, has achieved great success because they produce high-quality battery backups that are not too expensive. even so, another company that produces lower-quality batteries at the same price has also achieved some success, but not as much as jumpstart. also, in general, the price of backup batteries has declined because of economies of scale and learning. in addition, jumpstart has added complementary assets, such as a carrying case. considering all of these factors, the backup battery industry is most likely in the introduction stage. growth stage. shakeout stage. maturity stage.

Answers: 2

Business, 22.06.2019 10:50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

Business, 22.06.2019 12:30

land, a building and equipment are acquired for a lump sum of $ 1,000,000. the market values of the land, building and equipment are $ 300,000, $ 800,000 and $ 300,000, respectively. what is the cost assigned to the equipment? (do not round any intermediary calculations, and round your final answer to the nearest dollar.)

Answers: 1

Business, 22.06.2019 19:50

On july 7, you purchased 500 shares of wagoneer, inc. stock for $21 a share. on august 1, you sold 200 shares of this stock for $28 a share. you sold an additional 100 shares on august 17 at a price of $25 a share. the company declared a $0.95 per share dividend on august 4 to holders of record as of wednesday, august 15. this dividend is payable on september 1. how much dividend income will you receive on september 1 as a result of your ownership of wagoneer stock

Answers: 1

You know the right answer?

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has t...

Questions

English, 13.04.2021 05:40

Chemistry, 13.04.2021 05:40

Chemistry, 13.04.2021 05:40

Biology, 13.04.2021 05:40

Mathematics, 13.04.2021 05:40

Mathematics, 13.04.2021 05:40

English, 13.04.2021 05:40

Mathematics, 13.04.2021 05:40

English, 13.04.2021 05:40

Mathematics, 13.04.2021 05:40

Mathematics, 13.04.2021 05:40