Business, 07.11.2019 02:31 monstergirl25

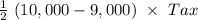

Suppose a tax is imposed on each new hearing aid that is sold. the supply curve is a typical upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. as a result of the tax, the equilibrium quantity of hearing aids decreases from 10,000 to 9,000, and the deadweight loss of the tax is $60,000. we can conclude that the tax on each hearing aid is:

Answers: 3

Another question on Business

Business, 21.06.2019 20:00

Which is not an example of a cyclical company? a) airlines b) hotel industry c) medical d) theme parks

Answers: 1

Business, 22.06.2019 12:20

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

Business, 22.06.2019 14:40

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u.s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

You know the right answer?

Suppose a tax is imposed on each new hearing aid that is sold. the supply curve is a typical upward-...

Questions

Mathematics, 09.04.2020 21:25

Mathematics, 09.04.2020 21:26

Mathematics, 09.04.2020 21:26

Health, 09.04.2020 21:26

Advanced Placement (AP), 09.04.2020 21:26

Mathematics, 09.04.2020 21:26

History, 09.04.2020 21:26

Biology, 09.04.2020 21:26