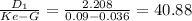

Laurel enterprises expects earnings next year of $3.68 per share and has a 30 % retention rate, which it plans to keep constant. its equity cost of capital is 9 %, which is also its expected return on new investment. its earnings are expected to grow forever at a rate of 2.7 % per year. if its next dividend is due in one year, what do you estimate the firm's current stock price to be?

Answers: 1

Another question on Business

Business, 21.06.2019 22:10

You have just received notification that you have won the $2.0 million first prize in the centennial lottery. however, the prize will be awarded on your 100th birthday (assuming you're around to collect), 66 years from now. what is the present value of your windfall if the appropriate discount rate is 8 percent?

Answers: 1

Business, 22.06.2019 01:20

Which of the following statements concerning an organization's strategy is true? a. cost accountants formulate strategy in an organization since they have more inputs about costs. b. businesses usually follow one of two broad strategies: offering a quality product at a high price, or offering a unique product or service priced lower than the competition. c. a good strategy will always overcome poor implementation. d. strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives.

Answers: 1

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

You know the right answer?

Laurel enterprises expects earnings next year of $3.68 per share and has a 30 % retention rate, whic...

Questions

Mathematics, 11.04.2021 18:40

Business, 11.04.2021 18:40

World Languages, 11.04.2021 18:50

Geography, 11.04.2021 18:50

Mathematics, 11.04.2021 18:50

Mathematics, 11.04.2021 18:50

English, 11.04.2021 18:50

Geography, 11.04.2021 18:50

History, 11.04.2021 18:50

Geography, 11.04.2021 18:50