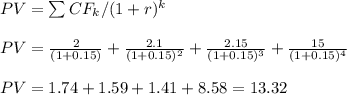

Suppose you are thinking of purchasing the stock of moore oil, inc. you expect it to pay a $2 dividend in one year, $2.10 in two years, $2.15 in three years, and you believe that you can sell the stock for $15 at the end of year three. if you require a return of 15% on investments of this risk, what is the maximum you would be willing to pay?

a. $14.6

b. $13.19

c. $13.33

d. $12.15

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 08:20

Which change is illustrated by the shift taking place on this graph? a decrease in supply an increase in supply o an increase in demand o a decrease in demand

Answers: 3

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

You know the right answer?

Suppose you are thinking of purchasing the stock of moore oil, inc. you expect it to pay a $2 divide...

Questions

Social Studies, 02.01.2020 00:31

Mathematics, 02.01.2020 00:31

English, 02.01.2020 00:31

Chemistry, 02.01.2020 00:31

Mathematics, 02.01.2020 00:31

Computers and Technology, 02.01.2020 00:31

Mathematics, 02.01.2020 00:31

Social Studies, 02.01.2020 00:31

Health, 02.01.2020 00:31

Mathematics, 02.01.2020 00:31

Mathematics, 02.01.2020 00:31