Business, 05.11.2019 04:31 raquelle66

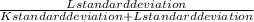

Consider two perfectly negatively correlated risky securities, k and l. k has an expected rate of return of 13% and a standard deviation of 19%. l has an expected rate of return of 10% and a standard deviation of 16%. the risk-free portfolio that can be formed with the two securities will earn rate of return.

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

In risk management, what does risk control include? a. risk identification b. risk analysis c. risk prioritization d. risk management planning e. risk elimination need this answer now : (

Answers: 3

Business, 22.06.2019 15:20

Sauer food company has decided to buy a new computer system with an expected life of three years. the cost is $440,000. the company can borrow $440,000 for three years at 14 percent annual interest or for one year at 12 percent annual interest. assume interest is paid in full at the end of each year. a. how much would sauer food company save in interest over the three-year life of the computer system if the one-year loan is utilized and the loan is rolled over (reborrowed) each year at the same 12 percent rate? compare this to the 14 percent three-year loan.

Answers: 3

Business, 22.06.2019 19:30

Problem page a medical equipment industry manufactures x-ray machines. the unit cost c (the cost in dollars to make each x-ray machine) depends on the number of machines made. if x machines are made, then the unit cost is given by the function =cx+−0.3x2126x31,935 . how many machines must be made to minimize the unit cost?

Answers: 3

Business, 22.06.2019 20:30

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

You know the right answer?

Consider two perfectly negatively correlated risky securities, k and l. k has an expected rate of re...

Questions

History, 14.10.2019 00:00

English, 14.10.2019 00:00

Chemistry, 14.10.2019 00:00

Social Studies, 14.10.2019 00:00

Mathematics, 14.10.2019 00:00

Geography, 14.10.2019 00:00

Social Studies, 14.10.2019 00:00

Mathematics, 14.10.2019 00:00

Mathematics, 14.10.2019 00:00

English, 14.10.2019 00:00

Mathematics, 14.10.2019 00:10

Mathematics, 14.10.2019 00:10

..................1

..................1