Business, 02.11.2019 05:31 PerfectMagZ

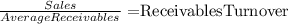

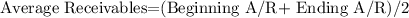

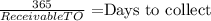

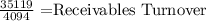

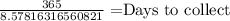

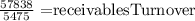

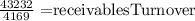

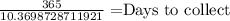

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]coca-cola and pepsico are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. to evaluate their ability to collect on credit sales, consider the following information reported in their 2010, 2009, and 2008 annual reports (amounts in millions).coca-colapepsico fiscal year ended: 2010 2009 2008 2010 2009 2008 net sales $ 35,119 $ 30,990 $ 31,944 $ 57,838 $ 43,232 $ 43,251 accounts receivable 4,478 3,813 3,141 6,467 4,714 3,784 allowance for doubtful accounts 48 55 51 144 90 70 accounts receivable, net of allowance 4,430 3,758 3,090 6,323 4,624 3,714 required: 1. calculate the receivables turnover ratios and days to collect for coca-cola and pepsico for 2010 and 2009. (use 365 days in a year. do not round intermediate calculations on accounts receivable turnover ratio. round your final answers to 1 decimal place. use final rounded answers from accounts receivable turnover ratio for days to collect ratio calculation.)

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

Forty-two percent of federal revenue comes from . income taxes paid by businesses and corporations make up about of federal revenue. taxes collected for social security and medicare make up of federal revenue.

Answers: 1

Business, 21.06.2019 21:30

Problem 2-18 job-order costing for a service company [lo2-1, lo2-2, lo2-3]speedy auto repairs uses a job-order costing system. the company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. the company applies all of its overhead costs to jobs based on direct labor-hours. at the beginning of the year, it made the following estimates: direct labor-hours required to support estimated output 10,000fixed overhead cost $ 90,000variable overhead cost per direct labor-hour $ 1.00 required: 1. compute the predetermined overhead rate.2. during the year, mr. wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. the following information was available with respect to his job: direct materials $ 600direct labor cost $ 180direct labor-hours used 2 compute mr. wilkes' total job cost. 3. if speedy establishes its selling prices using a markup percentage of 30% of its total job cost, then how much would it have charged mr. wilkes?

Answers: 1

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

You know the right answer?

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]c...

Questions

Mathematics, 30.07.2019 11:30

Mathematics, 30.07.2019 11:30

Mathematics, 30.07.2019 11:30

Biology, 30.07.2019 11:30

Chemistry, 30.07.2019 11:30

Chemistry, 30.07.2019 11:30

Biology, 30.07.2019 11:30

Mathematics, 30.07.2019 11:30

Computers and Technology, 30.07.2019 11:30

English, 30.07.2019 11:30

History, 30.07.2019 11:30

History, 30.07.2019 11:30

Arts, 30.07.2019 11:40