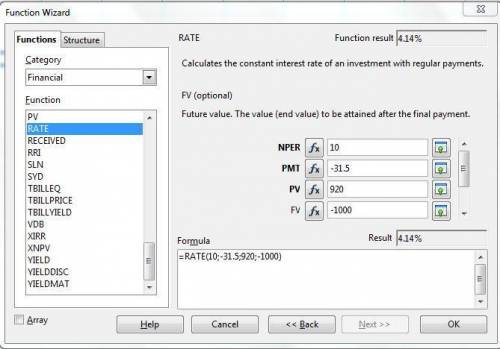

Avicorp has a $15.5 million debt issue outstanding, with a 6.3% coupon rate. the debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. it is currently priced at 92% of par value. a. what is avicorp's pre-tax cost of debt? note: compute the effective annual return. (another note: the pre-tax cost of debt is the yield to maturity (ytm) on the outstanding debt issue. we solve for the 6-month ytm on the bond: (this is what i have so not sure how they got $920 here: ) ** $920 = (31.50/(1+ytm)) + (31.50/(1+ytm)^2)) + (31.50/(1+ytm)^9)) + (31.50 + 1,000)/(1+ytm)^10) therefore, ytm = 4.1434% then compute the effective annual return (ear) as: ear = (1 + 0.041434)^2 -1 = 0.084585 the pre-tax cost of debt is 4.1434% every 6 months, or 8.4585% per year. b. if avicorp faces a 40% tax rate, what is its after-tax cost of debt? after-tax cost of debt = ear x (1-tc) where tc is avicorp's tax rate. then, after- tax cost of debt = 0.084585 x (1-0.4) = 0.050751 if avicorps faces a 40% tax rate, the after-tax cost of debt is 5.0751%.

Answers: 2

Another question on Business

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 15:40

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 21:10

Match the terms with their correct definition. terms: 1. accounts receivable 2. other receivables 3 debtor 4. notes receivable 5. maturity date 6. creditor definitions: a. the party to a credit transaction who takes on an obligation/payable. b. the party who receives a receivable and will collect cash in the future. c. a written promise to pay a specified amount of money at a particular future date. d. the date when the note receivable is due. e. a miscellaneous category that includes any other type of receivable where there is a right to receive cash in the future. f. the right to receive cash in the future from customers for goods sold or for services performed.

Answers: 1

You know the right answer?

Avicorp has a $15.5 million debt issue outstanding, with a 6.3% coupon rate. the debt has semi-annua...

Questions

Mathematics, 13.11.2020 21:50

English, 13.11.2020 21:50

English, 13.11.2020 21:50

Chemistry, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

History, 13.11.2020 21:50