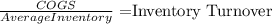

Multiple choice question 121 the following information pertains to ortiz company. assume that all balance sheet amounts represent both average and ending balance figures. assume that all sales were on credit. assets cash and short-term investments $ 45000 accounts receivable (net) 25000 inventory 12000 property, plant and equipment (net) 21 total assets $292000 liabilities and stockholders’ equity current liabilities $ 5 long-term liabilities 9 stockholders’ equity—common 152000 total liabilities and stockholders’ equity $292000 income statement sales (net) $ 12 cost of goods sold 66000 gross profit 54000 operating expenses 3 net income $24000 number of shares of common stock 6000 market price of common stock $20 dividends per share 0.5 what is the inventory turnover for ortiz?

Answers: 3

Another question on Business

Business, 22.06.2019 00:50

Cool beans is a locally owned coffee shop that competes with two large coffee chains, planeteuro and frothies. alicia, the owner, hired two students to count the number of customers that entered each of the coffee shops to estimate what percent of people who are interested in coffee are visiting each shop. after a week, the students found the following results: 589 visited cool beans, 839 visited planeteuro, and 1,290 visited frothies. the students were surprised that cool beans had 139 visits on monday which represented 59% of all people who visited one of the three coffee shops on mondays. how many people visited one of the three coffee shops during the week?

Answers: 2

Business, 22.06.2019 09:00

What should a food worker use to retrieve ice from an ice machine?

Answers: 1

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 20:10

With signals from no-claim bonuses and deductibles, a. the marginal cost curve for careful drivers lies to the left of the marginal cost curve for aggressive drivers b. auto insurance companies insure more aggressive drivers than careful drivers because aggressive drivers have a greater need for the insurance c. the market for car insurance has a separating equilibrium, and the market is efficient d. most drivers pay higher premiums than if the market had no signals

Answers: 1

You know the right answer?

Multiple choice question 121 the following information pertains to ortiz company. assume that all ba...

Questions

Mathematics, 30.06.2020 02:01

Chemistry, 30.06.2020 02:01

Mathematics, 30.06.2020 02:01

Chemistry, 30.06.2020 02:01

Mathematics, 30.06.2020 02:01

History, 30.06.2020 02:01

History, 30.06.2020 02:01

Mathematics, 30.06.2020 02:01

Mathematics, 30.06.2020 02:01

Mathematics, 30.06.2020 02:01

Health, 30.06.2020 02:01