Business, 29.10.2019 00:31 Danielyanez

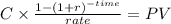

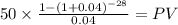

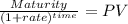

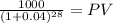

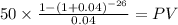

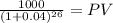

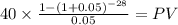

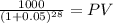

Miller corporation has a premium bond making semiannual payments. the bond pays a coupon of 10 percent, has a ytm of 8 percent, and has 14 years to maturity. the modigliani company has a discount bond making semiannual payments. this bond pays a coupon of 8 percent, has a ytm of 10 percent, and also has 14 years to maturity. what is the price of each bond today? price of miller corporation bond $ price of modigliani company bond $ interest rates remain unchanged, what do you expect the prices of these bonds to be 1 year from now? in 4 years? in 9 years? in 13 years? in 14 years? (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)price of bond miller corporation bond modigliani company bond 1 year $ $ 4 years $ $ 9 years $ $ 13 years $ $ 14 years $ $

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

Consider the local telephone company, a natural monopoly. the following graph shows the monthly demand curve for phone services and the company’s marginal revenue (mr), marginal cost (mc), and average total cost (atc) curves. 0 2 4 6 8 10 12 14 16 18 20 100 90 80 70 60 50 40 30 20 10 0 price (dollars per subscription) quantity (thousands of subscriptions) d mr mc atc 8, 60 suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. complete the first row of the following table. pricing mechanism short run long-run decision quantity price profit (subscriptions) (dollars per subscription) profit maximization marginal-cost pricing average-cost pricing suppose that the government forces the monopolist to set the price equal to marginal cost. complete the second row of the previous table. suppose that the government forces the monopolist to set the price equal to average total cost. complete the third row of the previous table. under average-cost pricing, the government will raise the price of output whenever a firm’s costs increase, and lower the price whenever a firm’s costs decrease. over time, under the average-cost pricing policy, what will the local telephone company most likely do

Answers: 2

Business, 22.06.2019 11:00

Aprofessional does specialized work that's primarily: degree based. medical or legal. well paying. intellectual and creative

Answers: 2

Business, 22.06.2019 18:00

Carlton industries is considering a new project that they plan to price at $74.00 per unit. the variable costs are estimated at $39.22 per unit and total fixed costs are estimated at $12,085. the initial investment required is $8,000 and the project has an estimated life of 4 years. the firm requires a return of 8 percent. ignore the effect of taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 3

Business, 22.06.2019 18:00

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

You know the right answer?

Miller corporation has a premium bond making semiannual payments. the bond pays a coupon of 10 perce...

Questions

History, 06.10.2019 07:30

History, 06.10.2019 07:30

History, 06.10.2019 07:30

Mathematics, 06.10.2019 07:30

Mathematics, 06.10.2019 07:30

Mathematics, 06.10.2019 07:30

Chemistry, 06.10.2019 07:30

Geography, 06.10.2019 07:30