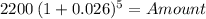

Kyle has $2,200 in cash received for high school graduation gifts from various relatives. he wants to invest it in a certificate of deposit (cd) so that he will have a down payment on a car when he graduates from college in five years. his bank will pay 2.6% per year, compounded annually, for the five-year cd. how much will kyle have in five years to put down on his car?

Answers: 1

Another question on Business

Business, 22.06.2019 05:20

What are the general categories of capital budget scenarios? describe the overall decision-making context for each.

Answers: 3

Business, 22.06.2019 15:10

You want to have $80,000 in your savings account 11 years from now, and you’re prepared to make equal annual deposits into the account at the end of each year. if the account pays 6.30 percent interest, what amount must you deposit each year? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 1

Business, 22.06.2019 16:20

The assumptions of the production order quantity model are met in a situation where annual demand is 3650 units, setup cost is $50, holding cost is $12 per unit per year, the daily demand rate is 10 and the daily production rate is 100. the production order quantity for this problem is approximately:

Answers: 1

Business, 23.06.2019 01:30

James jones is the owner of a small retail business operated as a sole proprietorship. during 2017, his business recorded the following items of income and expense: revenue from inventory sales $ 147,000 cost of goods sold 33,500 business license tax 2,400 rent on retail space 42,000 supplies 15,000 wages paid to employees 22,000 payroll taxes 1,700 utilities 3,600 compute taxable income attributable to the sole proprietorship by completing schedule c to be included in james’s 2017 form 1040. compute self-employment tax payable on the earnings of james’s sole proprietorship by completing a 2017 schedule se, form 1040. assume your answers to parts a and b are the same for 2018. further assume that james's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. calculate james's 2018 section 199a deduction.

Answers: 1

You know the right answer?

Kyle has $2,200 in cash received for high school graduation gifts from various relatives. he wants t...

Questions

History, 03.02.2021 05:20

Mathematics, 03.02.2021 05:20

Mathematics, 03.02.2021 05:20

History, 03.02.2021 05:20

Mathematics, 03.02.2021 05:20

Health, 03.02.2021 05:20

German, 03.02.2021 05:20

History, 03.02.2021 05:20

Mathematics, 03.02.2021 05:20

Mathematics, 03.02.2021 05:20