Business, 19.10.2019 00:10 ARandomPersonOnline

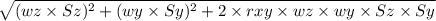

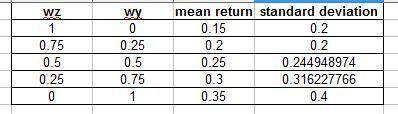

The expected returns and standard deviation of returns for two securities are as follows: security z security yexpected return 15% 35%standard deviation 20% 40%the correlation between the returns is + .25.(a) calculate the expected return and standard deviation for the following portfolios: 1i. all in zii. 75 in z and .25 in yiii. 5 in z and .5 in yiv. 25 in z and .75 in yv. all in y

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

The larger the investment you make, the easier it will be to: get money from other sources. guarantee cash flow. buy insurance. streamline your products.

Answers: 3

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 11:30

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: security z...

Questions

Mathematics, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

History, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

Arts, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

Mathematics, 06.05.2020 05:46

Biology, 06.05.2020 05:46

Biology, 06.05.2020 05:46