Business, 16.10.2019 04:30 MoltenSansriel1933

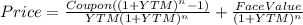

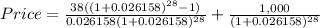

Harrison co. issued 15-year bonds one year ago at a coupon rate of 7.6 percent. the bonds make semiannual payments. if the ytm on these bonds is 5.3 percent, what is the current dollar price assuming a $1,000 par value? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 23.06.2019 01:50

The de mesa family will soon be occupying their newly renovated house. however, the bathroom measuring 10ft. by 16 ft. still needs to be covered by tiles. if the tile that they desire measures 2/5 ft by 2/5 ft., how many tiles will they need to cover the bathroom floor?

Answers: 3

Business, 23.06.2019 08:30

Which of the following scenarios will probably cause prices to drop

Answers: 3

You know the right answer?

Harrison co. issued 15-year bonds one year ago at a coupon rate of 7.6 percent. the bonds make semia...

Questions

Social Studies, 15.11.2019 22:31

Advanced Placement (AP), 15.11.2019 22:31

History, 15.11.2019 22:31

Arts, 15.11.2019 22:31

Mathematics, 15.11.2019 22:31

English, 15.11.2019 22:31

Mathematics, 15.11.2019 22:31

Health, 15.11.2019 22:31

Mathematics, 15.11.2019 22:31