Business, 16.10.2019 03:20 alarconanais07

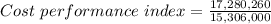

Aproject to build a new bridge seems to be going very well since the project is well ahead of schedule and costs seem to be running very low. a major milestone has been reached where the first two activities have been totally completed and the third activity is 63% complete. the planners were only expecting to be 52% through the third activity at this time. the first activity involves prepping the site for the bridge. it was expected that this would cost $1,422,000 and it was done for only $1,302,000. the second activity was the pouring of concrete for the bridge. this was expected to cost $10,502,000 but was actually done for $9,002,000. the third and final activity is the actual construction of the bridge superstructure. this was expected to cost a total of $8,502,000. to date they have spent $5,002,000 on the superstructure. calculate the schedule variance, schedule performance index, and cost performance index for the project to date. (round your "performance index" values to 3 decimal places.) schedule variance $ schedule performance index cost performance index

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Renaldo scanlon is a financial consultant. he earns $30 per hour and works 32.5 hours a week. what is his straight-time pay?

Answers: 1

Business, 22.06.2019 08:40

Which of the following is not a characteristic of enterprise applications that cause challenges in implementation? a. they introduce "switching costs," making the firm dependent on the vendor. b. they cause integration difficulties as every vendor uses different data and processes. c. they are complex and time consuming to implement. d. they support "best practices" for each business process and function. e. they require sweeping changes to business processes to work with the software.

Answers: 1

Business, 22.06.2019 19:30

Fly-by products, inc. operates primarily in the united states and has several segments. for the following segment, determine whether it is a cost center, profit center, or investment center: international operations- acts as an independent segment responsible for all facets of the business outside of the united states. select one: a. cost center b. profit center c. investment center

Answers: 2

Business, 22.06.2019 21:40

The farmer's market just paid an annual dividend of $5 on its stock. the growth rate in dividends is expected to be a constant 5 percent per year indefinitely. investors require a 13 percent return on the stock for the first 3 years, a 9 percent return for the next 3 years, a 7 percent return thereafter. what is the current price per share? select one: a. $212.40 b. $220.54 c. $223.09 d. $226.84 e. $227.50 previous pagenext page

Answers: 2

You know the right answer?

Aproject to build a new bridge seems to be going very well since the project is well ahead of schedu...

Questions

SAT, 26.01.2022 14:50

Health, 26.01.2022 14:50

Advanced Placement (AP), 26.01.2022 14:50

SAT, 26.01.2022 14:50

Mathematics, 26.01.2022 15:00

Mathematics, 26.01.2022 15:00