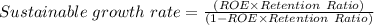

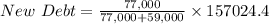

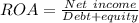

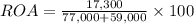

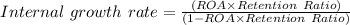

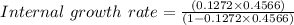

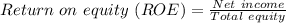

You've collected the following information about molino, inc.: sales $ 215,000 net income $ 17,300 dividends $ 9,400 total debt $ 77,000 total equity $ 59,000 a. what is the sustainable growth rate for the company? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. if it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what growth rate could be supported with no outside financing at all? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

Business, 22.06.2019 15:30

The school cafeteria can make pizza for approximately $0.30 a slice. the cost of kitchen use and cafeteria staff runs about $200 per day. the pizza den nearby will deliver whole pizzas for $9.00 each. the cafeteria staff cuts the pizza into eight slices and serves them in the usual cafeteria line. with no cooking duties, the staff can be reduced by half, for a fixed cost of $75 per day. should the school cafeteria make or buy its pizzas?

Answers: 3

Business, 22.06.2019 17:30

The purchasing agent for a company that assembles and sells air-conditioning equipment in a latin american country noted that the cost of compressors has increased significantly each time they have been reordered. the company uses an eoq model to determine order size. what are the implications of this price escalation with respect to order size? what factors other than price must be taken into consideration?

Answers: 1

You know the right answer?

You've collected the following information about molino, inc.: sales $ 215,000 net income $ 17,300...

Questions

Mathematics, 16.12.2020 17:50

English, 16.12.2020 17:50

Chemistry, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

Biology, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

Biology, 16.12.2020 17:50

History, 16.12.2020 17:50

History, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

Mathematics, 16.12.2020 17:50

![=1-[\frac{9,400}{17,300}]](/tpl/images/0305/8489/581d6.png)