Business, 10.10.2019 00:30 saigeshort

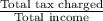

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity there are no exemptions or deductions. income tax rate $0-$20,000 5% $20,000-$50,000 20 $50,000-$100,000 45 over $100,000 55 suppose the couple's income is $60 comma 000. what is the couple's marginal tax rate? the couple's marginal tax rate is 45 percent. (enter your response as an integer.) what is their average tax rate? the couple's average tax rate is nothing percent. (enter your response as an integer)

Answers: 2

Another question on Business

Business, 21.06.2019 19:00

Danielle enjoy working as in certified public accountant (cpa) and assisting small business and individuals with managing their financial and taxes . which general area of accounting is her specialty ?

Answers: 1

Business, 22.06.2019 01:30

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 11:40

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

You know the right answer?

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity...

Questions

Health, 23.11.2019 05:31

Biology, 23.11.2019 05:31

Physics, 23.11.2019 05:31

Geography, 23.11.2019 05:31

Biology, 23.11.2019 05:31

Mathematics, 23.11.2019 05:31

Mathematics, 23.11.2019 05:31

History, 23.11.2019 05:31

Mathematics, 23.11.2019 05:31

English, 23.11.2019 05:31

History, 23.11.2019 05:31

Mathematics, 23.11.2019 05:31

Mathematics, 23.11.2019 05:31