Business, 05.10.2019 05:20 bermudezsamanth

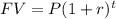

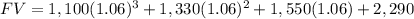

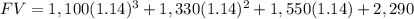

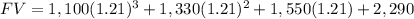

Problem 6-3 future value and multiple cash flows [lo1] fuente, inc., has identified an investment project with the following cash flows. year cash flow 1 $ 1,100 2 1,330 3 1,550 4 2,290 a. if the discount rate is 6 percent, what is the future value of these cash flows in year 4? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. if the discount rate is 14 percent, what is the future value of these cash flows in year 4? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. if the discount rate is 21 percent, what is the future value of these cash flows in year 4? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 21.06.2019 20:00

Which of the following statements is true about financial planning

Answers: 2

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

Business, 22.06.2019 13:40

Randall's, inc. has 20,000 shares of stock outstanding with a par value of $1.00 per share. the market value is $12 per share. the balance sheet shows $42,000 in the capital in excess of par account, $20,000 in the common stock account, and $50,500 in the retained earnings account. the firm just announced a 5 percent (small) stock dividend. what will the balance in the retained earnings account be after the dividend?

Answers: 1

You know the right answer?

Problem 6-3 future value and multiple cash flows [lo1] fuente, inc., has identified an investment pr...

Questions

Biology, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50

Social Studies, 07.06.2021 18:50

World Languages, 07.06.2021 18:50

History, 07.06.2021 18:50

Mathematics, 07.06.2021 18:50