Business, 06.10.2019 02:30 prettyboib22

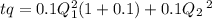

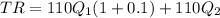

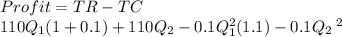

Consider a two-period model of a perfectly competitive firm that owns the rights to a finite deposit of a non-renewable resource. the firm’s total recoverable reserve of the resource is 575 tons, which the firm expects to extract fully over two periods. the firm’s total extraction costs are given by the function )=0.1qt2. the market price of the resource is expected to remain constant at $110 per ton. the market interest rate is 10 percent.(a) solve for the firm’s efficient extraction quantities in each of the two periods.(b) confirm that the efficient extraction quantities are consistent with the hotelling rule.

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

An office manager is concerned with declining productivity. despite the fact that she regularly monitors her clerical staff four times each day—at 9: 00 am, 11: 00 am, 1: 00 pm, and again at 3: 00 pm—office productivity has declined 30 percent since she assumed the helm one year ago. would you recommend that the office manager invest more time monitoring the productivity of her clerical staff? explain.

Answers: 3

Business, 22.06.2019 10:50

Explain whether each of the following events increases, decreases, or has no effect on the unemployment rate and the labor-force participation rate.a. after a long search, jon finds a job.b. tyrion, a full-time college student, graduates and is immediately employed.c. after an unsuccessful job search, arya gives up looking and retires.d. daenerys quits her job to become a stay-at-home mom.e. sansa has a birthday, becomes an adult, but has no interest in working.f. jaime has a birthday, becomes an adult, and starts looking for a job.g. cersei dies while enjoying retirement.h. jorah dies working long hours at the office.

Answers: 2

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

You know the right answer?

Consider a two-period model of a perfectly competitive firm that owns the rights to a finite deposit...

Questions

English, 20.08.2020 01:01

English, 20.08.2020 01:01

Mathematics, 20.08.2020 01:01

English, 20.08.2020 01:01

Mathematics, 20.08.2020 01:01